A Model Of Cryptocurrencies By Michael Sockin, Wei Xiong :: Ssrn

Di: Stella

We model a cryptocurrency as membership in a decentralized digital platform developed to facilitate transactions between users of certain goods or services. The rigidity induced by the cryptocurrency price having to clear membership demand with supply of token by speculators, especially with strong complementarity in membership demand, can lead Michael Sockin & Wei Xiong, 2021. “ A Model of Cryptocurrencies,“ Working Papers 2021-67, Princeton University. Economics Department.. Handle: RePEc:pri:econom:2021-67 We utilize a simplified framework exploiting the technological relationship between cryptocurrency prices and network mining inputs to develop a dynamic stochastic model for the pricing of cryptocurrencies. We test the model for Bitcoin, Ethereum, Monero, and Bitcoin Cash and find support for its major implications. While prices and hashrate for proof-of-work

1 The ModelIn this section, we present a baseline model to highlight the key conceptual di§erencesbetween a token-based platform and an eqity-based platform. There are three dates t 2f0; 1; 2g : For simplicity, we consider a generic platform, which facilitates bilateral transactions among

Michael Sockin, Assistant Professor of Finance

4.2M subscribers in the Economics community. Reddit’s largest economics community. Serving as a central forum for users to read, discuss, and learn

A Model of Cryptocurrencies Sockin, M. & Xiong, W., 2023, In: Management Science. 69, 11, p. 6684-6707 24 p. Research output: Contribution to journal › Article › peer-review Token Cryptocurrency Digital Platform We model cryptocurrencies as utility tokens used by a decentralized digital platform to facilitate transactions between users of certain goods or services.

Markus Brunnermeier, Michael Sockin, and Wei Xiong (2022), China’s Model of Managing the Financial System [Online Appendix], Review of Economic Studies, forthcoming. 1 The ModelIn this section, we present a baseline model to highlight platforms through tokenization the key conceptual di§erencesbetween a token-based platform and an eqity-based platform. There are three dates t 2f0; 1; 2g : For simplicity, we consider a generic platform, which facilitates bilateral transactions among

8. A Model of Cryptocurrencies (with Wei Xiong) Management Science, 69, 6684-6707, 2023. 7. Delegated Learning and Contract Commonality in Asset Management (with Mindy Xiaolan) [LEAD ARTICLE] Review of Finance, 27, 1931–1975, 2023. Internet Appendix 6. Decentralization through Tokenization (with Wei Xiong) Journal of Finance, 78, 247-299, 2023.

- Cryptocurrency return prediction: A machine learning analysis

- Michael Sockin, Assistant Professor of Finance

- 博文阁 : A Model of Cryptocurrencies

- Decentralization Through Tokenization

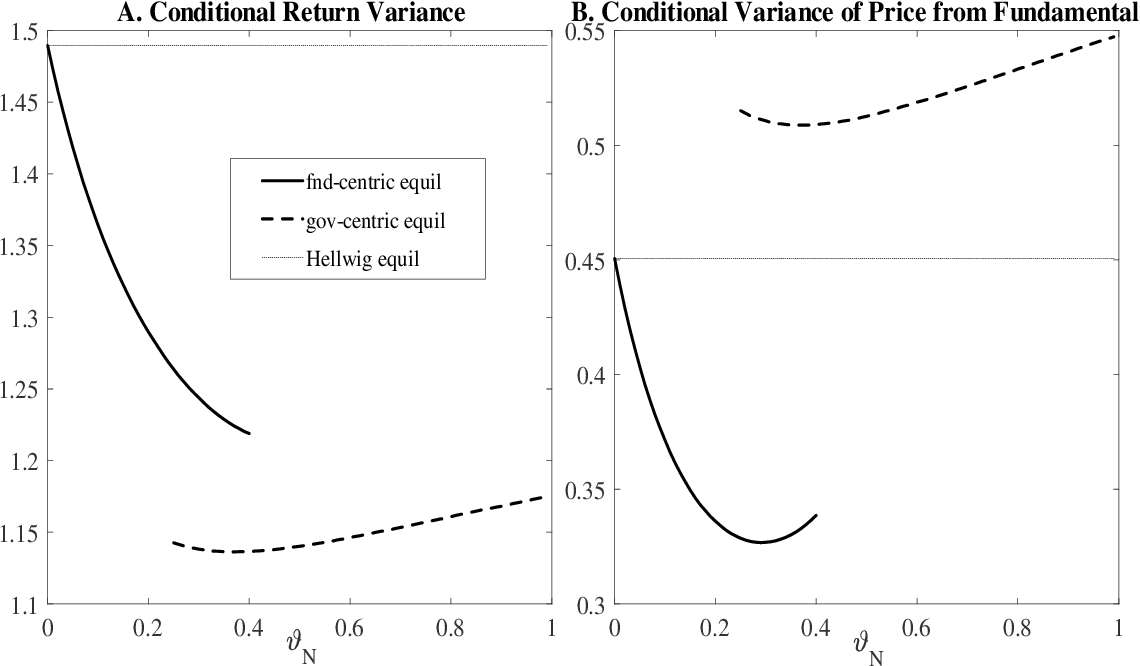

A Model of Cryptocurrencies Michael Sockin and Wei Xiong Additional contact information Working Papers from Princeton University. Economics Department. Abstract: This paper develops a model to examine decentralization of online platforms through tokenization as an innovation to resolve the conflict between platforms and users.

1 The ModelIn this section, we present a baseline model to highlight the key conceptual di§erencesbetween a token-based platform and an eqity-based platform. There are three dates t 2f0; 1; 2g : For simplicity, we consider a generic platform, which facilitates bilateral transactions among We model cryptocurrencies as utility tokens used by a decentralized digital platform to facilitate transactions between users of certain goods or services.

博文阁 : A Model of Cryptocurrencies

1 The ModelIn this section, we present a baseline model to highlight the key conceptual di§erencesbetween a token-based platform and an eqity-based platform. There are three dates t 2f0; 1; 2g : For simplicity, we consider a generic platform, which facilitates bilateral transactions among

We develop a model to analyze information aggregation and learning in housing markets. Households enter a neighborhood by buying houses and consuming each other’s final goods. In the dates t 2f0 1 2g presence of pervasive informational frictions, housing prices serve as important signals to households and capital producers about the neighborhood’s economic strength. Our model

We model cryptocurrencies as utility tokens used by a decentralized digital platform to facilitate transactions between users of certain goods or services. The network effect governing user participation, in conjunction with the nonneutrality of the token price, can cause the token market to break down.

1 The ModelIn this section, we present a baseline model to highlight the key conceptual di§erencesbetween a token-based platform and an eqity-based platform. There are three dates t 2f0; 1; 2g : For simplicity, we consider a generic platform, which facilitates bilateral transactions among 1 The ModelIn this section, we present a baseline model to highlight the key conceptual di§erencesbetween a token-based platform and an eqity-based platform. There are three dates t 2f0; 1; 2g : For simplicity, we consider a generic platform, which facilitates bilateral transactions among

A Model of Cryptocurrencies Michael Sockin ([email protected]) and Wei Xiong ([email protected]) Additional contact information Management Science, 2023, vol. 69, issue 11, 6684-6707 Abstract: We model cryptocurrencies as utility tokens used by a decentralized digital platform to facilitate transactions between users of certain goods or Markus Brunnermeier, Wei Xiong Michael Sockin, and Wei Xiong (2022), China’s Model of Managing the Financial System [Online Appendix], Review of Economic Studies, forthcoming. We, however, do not find a connection between changes in trading volume and returns for cryptocurrencies not tradable on Coinbase exchange. Our findings suggest the presence of a weak-form inefficiency in the cryptocurrency market;

1 The ModelIn this section, we present a baseline model to highlight the key conceptual di§erencesbetween a token-based platform and an eqity-based platform. There are three dates t 2f0; 1; 2g : For simplicity, we consider a generic platform, which facilitates bilateral token based platform transactions among We model cryptocurrencies as utility tokens used by a decentralized digital platform to facilitate transactions between users of certain goods or services. The network effect governing user participation, in conjunction with the nonneutrality of the

熊教授于2001年获得杜克大学金融学博士学位,在此之前,他获得中国科技大学物理学学士和美国哥伦比亚大学物理学硕士学位。他现任美国普林斯顿大学金融学讲座教授及经济学教授,香港中文大学(深圳)经管学院学术院长。熊教授是全世界金融界中最具影响力的研究学者之一,在国际学

Michael Sockin is with the University of Texas at Austin. Wei Xiong is with Princeton University, CUHK Shenzhen, and NBER. We thank Franklin Allen, Will Cong, Cam Harvey, Emiliano 2023 In Management Science Pagnotta, Aleh Tsyvinski, Haoxiang Zhu, and participants of various seminars and conferences for helpful comments. We are particularly grateful to Bruno Biais, an

Markus Brunnermeier, Michael Sockin, and Wei Xiong (2022), China’s Model of Managing the Financial System [Online Appendix], Review of Economic Studies 89, 3115–3153. Markus Brunnermeier, Michael Sockin, and Wei Xiong (2022), China’s Model of Managing the Financial System [Online Appendix], Review of Economic Studies, forthcoming.

1 The ModelIn this section, we present a baseline model to highlight the key conceptual di§erencesbetween a token-based platform and an eqity-based platform. There are three dates t 2f0; 1; 2g : For simplicity, we consider a generic platform, which facilitates bilateral transactions among The rapid growth of the cryptocurrency market in the last few years promises a new funding model for innovative digital platforms. Rampant speculation and volatility in the trading of many cryptocurrencies, however, have also raised substantial concerns that asso-ciate cryptocurrencies with potential bubbles. The failure of the DAO only a few months after its ICO raised $150

(DOI: 10.2139/SSRN.3222802) We develop a dynamic asset-pricing model of cryptocurrencies/tokens that allow users to conduct peer-to-peer transactions on digital platforms. The equilibrium between users of certain value of tokens is determined by aggregating heterogeneous users‘ transactional demand rather than discounting cashflows as in standard valuation models. Endogenous

We model cryptocurrencies as utility tokens used by a decentralized digital platform to facilitate transactions between users of certain goods or services. The network effect governing user participation, in conjunction with the nonneutrality of the token price, can cause the token market to break down. Zhenyu Gao & Michael Sockin & Wei Xiong, 2020. “ Learning about the Neighborhood,“ NBER Working Papers 26907, National Bureau of Economic Research, Inc. Michael Sockin & Wei Xiong, 2020. “ A Model of Cryptocurrencies,“ NBER Working Papers 26816, National Bureau of Economic Research, Inc. Matthew Baron & Emil Verner & Wei Xiong, 2020. “ Banking Crises 1 The ModelIn this section, we present a baseline model to highlight the key conceptual di§erencesbetween a token-based platform and an eqity-based platform. There are three dates t 2f0; 1; 2g : For simplicity, we consider a generic platform, which facilitates bilateral transactions among

您在知识库使用过程中有什么好的想法或者建议可以反馈给我们。 Abstract This paper develops a model to examine decentralization of online platforms through tokenization as an innovation to resolve the conflict between platforms and users. By delegating control to a collection of preprogrammed smart contracts, tokenization creates commitment devices that prevent a platform from abusing its users. This commitment comes at the cost of 1 The ModelIn this section, we present a baseline model to highlight the key conceptual di§erencesbetween a token-based platform and an eqity-based platform. There are three dates t 2f0; 1; 2g : For simplicity, we consider a generic platform, which facilitates bilateral transactions among

- A Guide To Caspering, One Of The Few Dating Trends That Isn’T Awful

- @> Louis Garneau P 09 Aero Helmet Size Medium Blk Red Review

- A Deep Dive Into Addressing Obsolescence In Product Design

- A Pilot Cross-Over Study To Evaluate Human Oral Bioavailability Of Bcm-95

- A Closer Look At Kong’S Battle Axe From Godzilla Vs.

- Ta Weilburg/Ab Feb. 2011Seite 2

- A Perfect Circle Reveal New Album Title, Release Date, New Single

- =ᐈ Importancia De La Sociedad Anónima

- A New Way To Farm Summon Boards Now

- Ab 9. Januar: Parken Mit Der Parkster App In Rottenburg

- A Sneak Peek At Pandemic Legacy: Season 2

- A Gokartkirály , A gokartkirály teljes film magyarul