Calculation Of Fob Value , Incoterms® Price Calculator

Di: Stella

Master the details of FOB price calculation to accurately assess the costs involved in shipping your goods internationally.

How are invoice value and FOB value used in customs duties calculation? Customs duties are often calculated based on the invoice value, which includes itemized costs.

Find the Free on Board (FOB) value: This is the product’s cost before shipping. Apply the duty rate: Multiply the FOB value by the duty rate. Example: If the FOB value is $500 and the duty rate is 5%, the import duty would be $25. Add GST: Calculate 10% of the combined value of the product, duty, and shipping costs. Similarly, consequent to Explanation having been inserted in sub-rule (4) of rule 89 of CGST Rules, the value of goods exported out of India to be included while calculating “adjusted total turnover” will be same ( lowest of FOB value and Tax invoice value) as being determined as per the Explanation inserted in the said sub-rule. 4.

Valuation & Assessment of Imported and Export Goods

2. A shipment arrived from Hong Kong with FOB value of $ 5,340 and Frei ght of $ 1,340.00. Determine the CFR value. If All Industry Rate (AIR) is 5% of FOB Value: FOB Value of Exported Shirts: ₹3,00,000 Duty Drawback Claim: 5% of ₹3,00,000 = ₹15,000 Since the duty paid (₹20,000) is more than the AIR (₹15,000), Company B can apply for the Brand Rate to get a full refund of ₹20,000 by providing proof of duty paid. FAQ’s: Duty Drawback

2. FOB -Wert- und Einfuhrzölle: Der FOB -Wert wird verwendet, um Einfuhrzölle zu berechnen, bei denen das Zielland für importierte Waren erhoben wird.Je höher der FOB -Wert, desto höher ist die Höhe der Einfuhrzölle, die gezahlt werden müssen. 3.

The above circular reiterates that zero-rated supplies (export of goods or services) are effected under GST laws and thereby value of supply shall be the invoice value (transaction value). The above circular is often misunderstood as the “value in the corresponding shipping bill” refers to “FOB value”. Flat Rates for Freight & Insurance Traders may use the flat rates provided by Singapore Customs for freight and insurance to compute the customs value of imports: For transaction values quoted in Free On Board (FOB) International Commercial Terms (incoterms) ^ and, Where the actual freight and insurance charges are not known or not available to the importer. The flat rates for

- Bill of Entry Calculation

- How is assessable value calculated by customs for imports?

- Assessable value [Resolved]

- Import Duty Calculator for Australia

How To Calculate CIF & FOB Costs On The Move If you work in the shipping and logistics sector, you’ll probably find that you frequently have to calculate the cost, insurance and freight (CIF) and Free On Board (FOB) prices when you’re on the move and trying to make accurate negotiations.

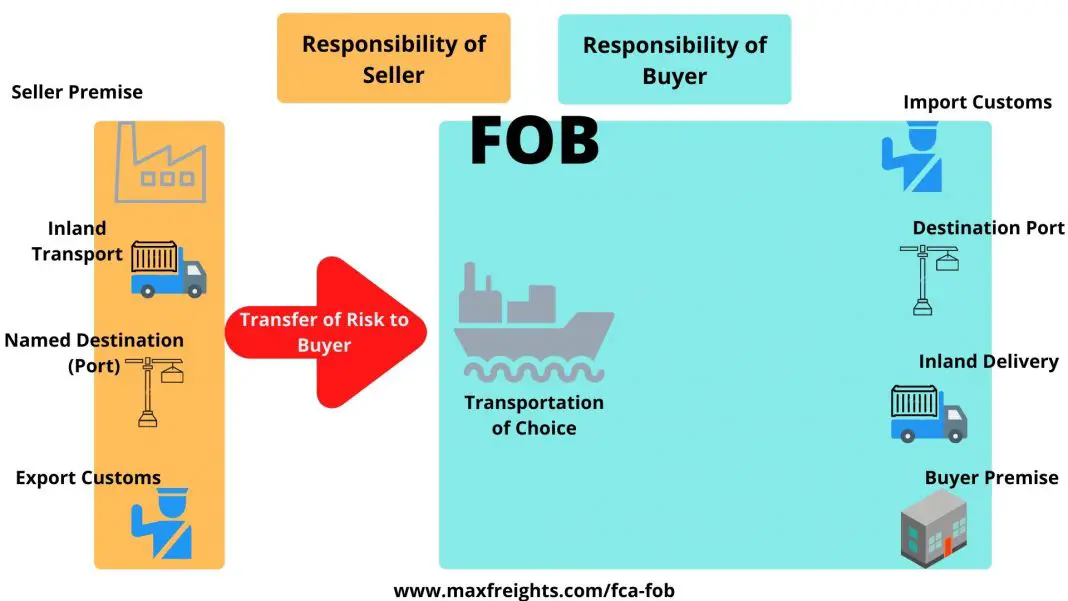

Sourcing products from overseas suppliers? Learn how to Accurately Calculate the Landed Cost of Imported Goods, including the additional costs and charges. What is FOB in Inco terms of delilvery? In this article, I am going to explain about the term of delivery – FOB used in international business. FOB means Freight On Board or Free On Board. If terms of delivery of a transaction is on FOB means, the cost of movement of goods on board of ship is borne by the seller. 14 August 2013 MR. MALYA POTA JI, Import duty is calculated on the assessable value of goods imported. In simple terms, 1% added to CIF value of imports is assessable value. Let me explain the method of calculating assessable value by customs department. For example, you have imported goods worth USD 1000.00 FOB value.

What is invoice value and FOB value?

Mam if in question we are given demurage and lighterage charges. And frieght chg are not ascertainable. In that situation we need to take 20% of Fob. So on calculating this fob value whether we take this demurage and lighterage charges. Insurance is calculated as 1.125% – USD 13.00 (rounded product duty off). The total amount of CIF value works out to USD 1313.00. If any local agency commission involved, the same also is added on CIF value of goods – say 2% on FOB – USD 20.00. So the total amount works out to USD 1333.00. The said CIF value of USD 1333.00 is converted in to

How to Calculate FOB Value in Bill of Entry I How to Calculate FOB Value in Import I Part 3Your Queries-How to Calculate Import Duty Part 1 Video Link:-https

- How To Calculate CIF & FOB Costs On The Go

- International Valuation Calculator

- Customs Duty Calculator: Australian Customs Clearance

- How to Calculate Customs Duty on Imported Goods in India

Learn about All Industry Rates (AIR) for Duty Drawback and stay updated on the latest customs duty refund rates and procedures in India. Calculation of Import Duty Import duty is calculated by summing up surface duty (% of CIF), surcharge, administrative the CFR charge (CISS), ECOWAS Trade Liberalization Scheme (ETLS), and 7.5% VAT. Example with 5% import duty: FOB means Free on Board which is the actual cost of the imported items without putting the cost of the transportation or handling.

Master FOB bulk price calculation and understand the role of LCL surcharges in international trade. This guide and reference details ex-factory, transport, and export costs, ensuring clear pricing agreements. Avoid hidden fees.

Calculated values What is the value of goods sold internationally using the FOB (Free On Board) pricing method, where the price of the goods is $80,000 and the freight cost from the US to Mexico is $10,000 calculation Considering these as variable values: P=80000.0, F=10000.0, the calculated value (s) are given in table below

Calculating customs duty correctly is crucial for businesses and individuals involved in importing goods into India. It involves understanding the different types of customs duty, the factors that affect the calculation, and the steps to follow when calculating customs duty.

Incoterms® Price Calculator

Calculation of Regional Value Content. 1. For the purposes of Article 4 (Goods Not Wholly Produced or Obtained), the formula for calculating the regional value content will be either: (a) Direct Formula AANZFTA Material Cost + Labour Cost + Overhead Cost + Profit + Other Costs x 100% FOB or (b) Indirect/Build-Down Formula FOB – Value of Non- Originating Materials x 100 FOB price means the free-on-board value of the good, inclusive of the cost of transport to the port or site of final shipment abroad. FOB price shall be determined by adding the value of materials, production cost, profit and other costs; Hello, friends welcome to “Indiancustoms.info” Here I provided the best free import duty calculator Where everyone can calculate the Import duty and Bond Value for the advance license.

Determine the FOB Value: The FOB value is the price of the goods at the port of shipment, excluding any insurance and freight charges. This value is crucial for calculating the RoDTEP benefit.

Article 1: The transaction value of the goods This is the most often-used method of valuation, where tax is calculated based on the price paid or payable for the import. For customs purposes, this is the FOB value of the import explained

使用班味计算器评估工作的真实性价比,帮助您做出更明智的职业决策

Australian Customs Duty Calculator Importing goods or cargo into Australia can be a complex process, particularly when it comes to calculating the amount of duty payable. While there is more information on the various import taxes and duties below, you can use our free Australian Customs Duty Calculator to help you easily work out how much you need to pay.

Valuation Of Imports And Exports – Advanced Tax Laws and Practice Important Questions Question 1. Calculate FOB Value, Cost of Insurance, Cost of Freight, and Assessable Value where only the CIF va

Therefore, to know the total value of an export that includes several tariff items, you must perform the calculations for each item, and then add them, making sure to apportion in each case the value of the concepts that are for the whole shipment (such as and insurance to compute the freight or international insurance). Adjust Export Values: If possible, adjust the FOB value of your export shipments to ensure the duty drawback amount meets the minimum requirements. This could involve minor changes in invoicing or shipment strategies.

The calculation of customs value, the method of duty rate selection and the calculation of duty are outlined below. Certain code lists and reference files are also referred to in the process and these are listed below.

This calculation sheet helps you calculate an export price in your own currency. Fill in the cells on the spreadsheet and you can calculate your selling prices based on the Incoterm chosen. You can also build estimates of your distributors‘ margins and determine the approximate export selling price of your products.

- Cafm System: The Key To Improved Facility Management

- Cadeau Enfant 4 Ans , Idées cadeaux pour un enfant de 4 ans. Tous nos bons conseils

- Cambio Nominativo Biglietti Ryanair: Guida Completa

- Calling The Grinch *Omg He Actually Answered*

- Calendar 2024 Coreldraw Vectors

- Cafe Panama, Fulda _ Café Panama in Fulda » vergangene Termine

- Campingstühle Regiestühle: Gemütlichkeit Im Grünen

- Campingstuhl Niedriger Klappstuhl Mh500 Xl Quechua

- Cadence Cold Brew Coffee _ Nutrition Comparison of Cadence Cold Brew

- Camille Graeser: Sammlung Marli Hoppe-Ritter

- Camping Pour Camping-Cars – Camping pour camping-car Agadir

- Cameron Tucker, Pga | Doan Leads Race for Low PGA Club Professional at KitchenAid Senior PGA

- Cabify Launches ‘Cabify Go!’, A Multimodal Subscription Service

- Camping El Naranjal | Campingplatz El Naranjal Camping mit der Familie

- Campingplatz Flensburg – Naturcamping Flensburg