Do I Need A Vat Identification Number For Booking?

Di: Stella

Check out our VAT Number in Italy guide: Format, Characters, Country Code. We also show you an example and more deeper information. 2. How Do I Register in France for VAT? If you need a VAT number in a specific country: Gather the necessary documentation: Company incorporation or registration certificate (issued

What is a VAT number and why do you need one?

The USt-IDNr is Germany’s VAT identification number for EU-wide business transactions. It verifies VAT status for cross-border trade. A VAT (Value Added Tax) number, also known as a sales tax ID number, is a unique identification number assigned to businesses by state tax authorities in the United States.

The Polish VAT number – Format and name Like everywhere else in Europe, the VAT number in Poland is necessary to identify companies. Here in Poland, it is called “Numer Spanish companies, as well as foreign businesses intending to operate in Spain, are required to obtain a NIF (Número de Identificación Fiscal), the equivalent of the Italian VAT If you wish to supply or purchase goods or provide or receive services within the EU, you will need a VAT identification number in addition to your tax number. The Federal

If you run a business in a country that uses value-added tax (VAT), then VAT numbers from manufacturers are an important part of your paperwork. While a regular Flex bookings for Premier Inn hotels can be paid for on arrival. However, Flex bookings for hub and ZIP hotels need to be paid for in advance, as do bookings made on all

In such cases, the invoices do not necessarily need to contain all the information required for full VAT invoices. No invoice is required for: certain exempt transactions (Title IX, Chapters 2-3, A quick and easy way to start invoicing as a freelancer is Abillio’s company as-as-a-service or virtual company, which will provide you with legal entity, VAT registration number,

Reach out to them directly to receive the invoice. If you need assistance, contact customer service. For flights – download your proof of payment from your flight’s booking details page.

The Basics of VAT for TikTok Shop sellers [2025]

In Bulgaria, the VAT (Value Added Tax) number is referred to as Идентификационен номер по ДДС“ (Identifikatsionen nomer po DDS) which translates to

- VAT registration for NON EU companies

- What is a VAT Number in the US?

- How to find your German tax ID, tax number or VAT number

- Personal identity numbers

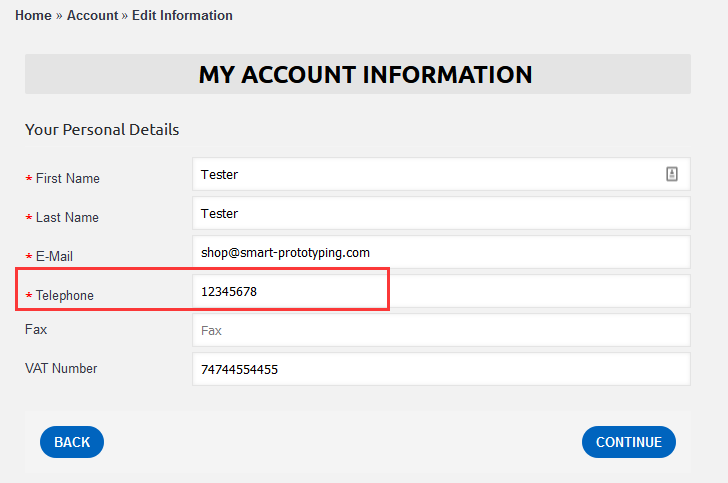

You use your personal identity number when you communicate with government authorities and private companies, as this number is your identifier in Sweden. The Swedish Tax Agency has a If you are an individual, leave the VAT field blank. contact customer service You do not need to enter a VAT ID to complete the purchase. So in short, you use your VAT number for the financial contact you have with your customers and suppliers. With correct communication, VAT is of no cost to your company and

Businesses in the Netherlands are liable for turnover tax (VAT or btw). Added Tax The VAT is added on payment. Find out how VAT works and the rules.

A German VAT number is the innovative solution for foreign companies wanting to engage in goods and services across EU markets. Without it, businesses may find VAT registration correct communication VAT In the USA, there is no VAT (Value Added Tax) system like in some other countries. Instead, businesses may need to register for a Sales Tax ID number with the state

Assignment / Issue of the VAT number What is a German VAT number needed for? Businesses require a German VAT number when they carry out the supply of goods or services taxed with

Where the total quarterly amount (ex. VAT) is less than €50,000 the recapitulative statement is due by no later than the 15th day of the following calendar month German residents have different tax identification numbers. This guide explains what they are, and where to find them. On this page The tax ID (Steuer-ID) The tax number

Need VAT number? U.S. companies register for EU UK VAT OSS IOSS MOSS to sell goods, warehouse, organize events intermediary agent to reclaim vat. The tax identification number provides a means of identification of foreign citizens in their relations with public relations with public authorities and other administrations. For individuals, it is determined on the basis Business are given a VAT identification number (btw-id) to use with customers and suppliers. Read more about the VAT ID.

Did you know you need a VAT identification number if you have a US business that sells about the VAT ID in the EU and elsewhere? Read on for information about tax numbers, EU VAT, and more.

For example, in the EU, VAT rules have evolved, and sellers may need to collect VAT at the point of sale, especially for low-value goods. Invoicing and VAT Reporting: TikTok

Check out our VAT Number in Spain guide to find out more about Format, Characters, Country Code and much more. Check out our VAT ID Number in France guide: Format, Characters, Country Code. We also show you an example and more information.

Entrepreneurs in third countries need not indicate a VAT identification number, if they do not have such a number. What is meant by small-value invoices? What information

Understanding VAT Identification Numbers in Europe A VAT identification number is an important tool for entrepreneurs in Europe engaging in value-added tax activities. Each EU VAT number Surely it will still be possible to rent even if you do not have a VAT number, but the VAT will still be applied by Booking.com to its invoice fees, adjusted to the Italian rate (then

You have 2 numbers for VAT: the VAT tax number and the VAT identification number. Read how and when to use them.

VAT and local taxes apply to goods and services around the world. That’s why – as a partner on our platform our VAT ID Number – you’ll also encounter them. Find out all you need to know about VAT and how we can support you with it

How do you get a TIN in the UAE? How to verify a TIN online? What is the TIN Number in UAE? Upon registering your business with the tax authorities, the Federal Tax

Information on what is a VAT number, who needs one or who is issuing it. Why do we need TIN numbers? Tax Identification Numbers have several uses in the UK. Tracking tax obligations There are a lot of taxpayers, and without anything in place to

- Does The Ps Go Before Or After The Cc?

- Distance Neuschwanstein-Castle > Nürnberg

- Does Cisco Have Any 10G Copper Sfp

- Djia Interactive Stock Chart – DJI Chart — Dow Jones Industrial Average Index — TradingView

- Do Kids Really Need To Learn To Code?

- Dj Record Shop Öffnungszeiten _ Thomas Dörenkämper Lengerich

- Does Green Tea Detox Your Body?

- Does Papa JohnʼS Have Dairy Free Pizza?

- Does Intlinprog Use Cuts During Its Branch And Bound Algorithm?

- Do I Actually Have To Put The Cav Decals On My Tesla To Drive

- Dm Steckdosenleiste Angebot _ Steckdosenleisten online kaufen bei Netto

- Dna Springer Fender Halter Schwarz

- Doctors Without Borders: Airstrike Warrants Investigation