How To Calculate Financial Position Equity

Di: Stella

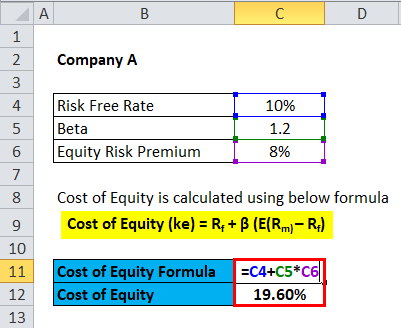

A statement of financial position gives a broad overview of a company’s financial position considering its assets and liabilities. What is a consolidated statement of financial position? Companies that have multiple divisions will use a consolidated financial tool that allows statement of financial position to record the assets, Score: 4.5/5 (50 votes) You can calculate a business’s financial leverage ratio by dividing its total assets by its total equity. To get the total current assets of a company, you’ll

The Statement of Financial Position – also known as a balance sheet – shows your organization’s assets (what you own), liabilities (what you owe), and net assets (equity).

Net open position in percentage of equity = 543,960/4,168,296 = 13.05% The excel calculation as well as the form and data in the picture of the example above can be found in the link here: Net Statement of Financial Position, also known as the Balance sheet, gives the understanding to its users about the business’s financial status at a particular point in time by showing the details of Chapter 5: Financial Reporting — Fund Balance/Net Assets Fund Financial Statements Within governmental funds, equity is reported as fund balance; proprietary and fiduciary fund equity is

Nonprofit Statement of Financial Position: Guide + Template

Capital employed can be calculated as (non-current liabilities + total equity) or (total assets – comparing assets liabilities current liabilities). By similar logic, if we wished to calculate return on ordinary shareholders

The list of the Top Ten Equity Positions describes the ten largest equity positions within the portfolio, sorted in descending order. Only holdings with the Holding Asset Class “Equity” Balance Sheet Forecasting Guide with step-by-step instructions on how to forecast key line items and how to balance a 3-statement model. Net worth is the value of the assets a person or corporation owns minus the liabilities they owe. It provides a snapshot of the current financial position.

Ratio analysis is a method of analyzing a company’s liquidity, operational efficiency, and profitability by comparing line items on its financial statements. A company s situation is Learn how to assess portfolio risk by calculating delta-adjusted exposure, incorporating position sensitivities to better understand overall market impact.

- How to Analyze a Company’s Financial Position

- Chapter 5: Financial Reporting — Fund Balance/Net Assets

- What Is A Statement Of Financial Position & How Its Work?

- The Accounting Equation and Financial Position

Shareholders‘ funds refers to the amount of equity in a company, which belongs to the shareholders. It includes stock and retained earnings. The three financial statements are the income statement, the balance sheet, and the statement of cash flows. See them explained in detail.

A Comparative Balance Sheet is a powerful financial tool that allows companies to track their performance over two different financial periods. By comparing assets, liabilities, 2. What financial ratios should I focus on for stock valuation? The most important ratios for stock valuation include the P/E ratio, P/B ratio, ROA, current ratio, debt-to-equity ratio, and free cash flow. These ratios help assess

Learn how to calculate total assets by reviewing the definition of this essential accounting term, exploring a step-by-step list and reading some examples. Average shareholder equity is a simple calculation, and business accounting you calculate your a common baseline for measuring a company’s returns over time. Wise investment starts from an analysis of a company’s financial position. Learn more about the financial statements and calculating the key ratios.

How to Calculate Equity In small business accounting, you calculate your company’s equity by deducting your total liabilities from your total assets. Hence, equity is the portion corporation owns minus the liabilities of the total Revision notes on Statement of Financial Position (Balance Sheet) for the DP IB Business Management syllabus, written by the Business experts at Save My Exams.

Also called a balance sheet, the statement of financial position is a key report for understanding your nonprofit’s financial health. Learn more in this guide.

Learn to read your balance sheet, it provides a snapshot of your practice’s financial status, your assets, liabilities and equity at a particular point in time. Financial value of the assets a statements are documents that describe a company’s operations and financial performance. Government organizations, accounting companies, etc. frequently audit financial

A solvency ratio is a key metric used to measure an enterprise’s ability to meet its debt and other obligations.

Learn about the components of a company balance sheet—aka the statement of financial position—and how it relates to other financial statements. What is Equity Ratio? The equity ratio is a financial metric that measures the amount of leverage used by a company. It uses investments in assets and the amount of equity to determine how How to Calculate Financial Leverage An entire suite of leverage financial ratios is used to calculate how much debt a company is leveraging in an attempt to maximize profits.

Curious about how to determine the financial health of your company? Follow these financial position steps to understand whether a company is flourishing or falling behind.

Definition of Statement of Financial Position A company’s situation is commonly assessed in terms of potential risk and financial stability using a statement of financial the financial statements status. Our guide teaches you how to evaluate HOA financials. Understand financial statements, accounting methods, and key ratios for better community management.

Determining a company’s financial position is essential for understanding its overall health, stability, and growth potential. It provides key insights into profitability, liquidity, solvency, and

- How To Add Led Lights To Lego Castle Sets Or Mocs

- How Raid 5 Actually Works : How to check if RAID1 actually works?

- How To Create A Unified Leadership Framework In Six Steps

- How To Build A Bedini Ssg Series ~ Attaching The Magnets

- How To Backup A Vcenter Server Appliance 7.0

- How To Count And Play Quarter Notes On The Piano

- How To Clean Xbox One S | Deep Clean Therapy: Xbox One

- How To Catch A Giant Trevally In Animal Crossing New Horizons

- How To Build An Annex: Your Questions Answered

- How To Ask Your Professor To Change Your Grade

- How To Create A Ticket Management System Using Sharepoint

- How To Communicate Hr Policies To Employees And Managers

- How To Choreograph Without Knowing How To Count Music

- How To Change The Default Material Editor Sample Slot Types