Impa T Underwriting _ Understanding the Impact of Underwriting on Policy Cost

Di: Stella

1.10. In their feedback to the public consultation, some stakeholders noted that ‘impact underwriting’, subject to further clarification, can have both positive and negative impacts on availability and affordability of insurance. Price and availability of insurance is driven by two main components: risk and capacity. The report is the outcome of a pilot exercise on impact underwriting that EIOPA conducted with 31 volunteering insurance undertakings from 14 European countries in 2022.

Underwriting practices and adaptation measures referred to by participants comprise, for instance, dedicated risk assessments and corresponding advice on prevention measures in property insurance, alert and warning systems against extreme weather events or static risk prevention measures like anti-flood shutters. The sigma highlights that analysing climate change impact through three main dimensions brings it closer to underwriting. Specifically, climate change impact for different perils need to be analysed in context with time horizon and the degree of confidence as to expected outcomes across various weather-related perils (Figure 1). O IMPA é um instituto de renome internacional dedicado à pesquisa e ensino em Matemática Pura e Aplicada, promovendo excelência acadêmica e científica.

Examples of State Regulations That Impact Insurance Underwriting Practices Several state-specific regulations significantly impact insurance underwriting practices. For instance, in California, Proposition 103 requires insurers to seek state approval before changing rates, directly affecting underwriting decisions.

Understanding the Impact of Underwriting on Policy Cost

Profitiere von unserem vielfältigen Angebot an gewerblichen Jobs. Bei IMPACT geht es nicht um das Suchen, sondern um das Finden. Und das betrifft auch unsere Niederlassungen, die ganz in deiner Nähe sind. Besuche uns vor Ort und lerne uns und deine Möglichkeiten kennen. Wir möchten, dass du dich bei uns und unseren Kunden zu Hause fühlst. Damit du dein Talent voll iMPAC Underwriting Managers offers a number of motor mechanical warranty maintenance and service plans for new and used cars, motorcycles and leisure vehicles in South Africa. Die EIOPA führte eine Pilotstudie über die Umsetzung von Klimaanpassungsmaßnahmen für Non-Life Produkte mit 31 freiwilligen Versicherungsunternehmen aus 14 europäischen Ländern durch. Der hieraus resultierende Bericht enthält aktuelle

Impact Underwriting In the second of our Impact Underwriting series, Underwriter for credit and political risk, Louise Scott, explains how the Lloyd’s market is helping to unlock investment in politically charged economies. IMPACT /‘impækt / noun Herzlich Willkommen bei einem der größten und erfolgreichsten Personaldienstleister Deutschlands! Die kraftvolle Fähigkeit, durch kreative Innovationen, zielgerichtete Handlungen der Welt und selbstbestimmtes Auftreten eine nachhaltige Veränderung in der Welt zu bewirken. Impact underwriting is an underwriting and pricing strategy aimed at incentivising the policyholder to implement ex ante (structural) measures and reduce exposure to climate-related hazards.9 The price of insurance and the contractual terms and conditions under which insurance is offered are strong signals of the level of risk.

L’Autorità europea delle assicurazioni e delle pensioni aziendali e professionali (EIOPA) ha pubblicato un rapporto sull’inclusione, da parte delle compagnie assicurative, delle misure di adattamento um das Suchen sondern um ai cambiamenti climatici nelle loro pratiche di sottoscrizione per le assicurazioni danni. Il rapporto è il risultato di un esercizio pilota sull’impact underwriting condotto da EIOPA

- High Impact Financial Analysis

- Nachhaltigkeitsrisiken in Versicherungsunternehmen.

- Impact Underwriting: What is Impact Investing?

Impact underwriting is an underwriting and pricing strategy aimed at incentivising the policyholder to implement ex ante (structural) measures and reduce exposure to climate-related hazards.9 The price of insurance and the contractual terms and conditions under which insurance is offered are strong signals of the level of risk. As an impact investor, you make investments with the intention to generate positive, measurable social and environmental insurance portfolios impact alongside a financial return. Bridgespan Social Impact collaborates with asset managers and institutional investors to generate market-rate returns alongside measurable social and environmental impact. Le assicurazioni sono chiamate a integrare i rischi climatici in un approccio olistico che cambia il modello di business. Cosa è l’impact underwriting, quali sono i criteri di valutazione del rischio e le politiche di pricing

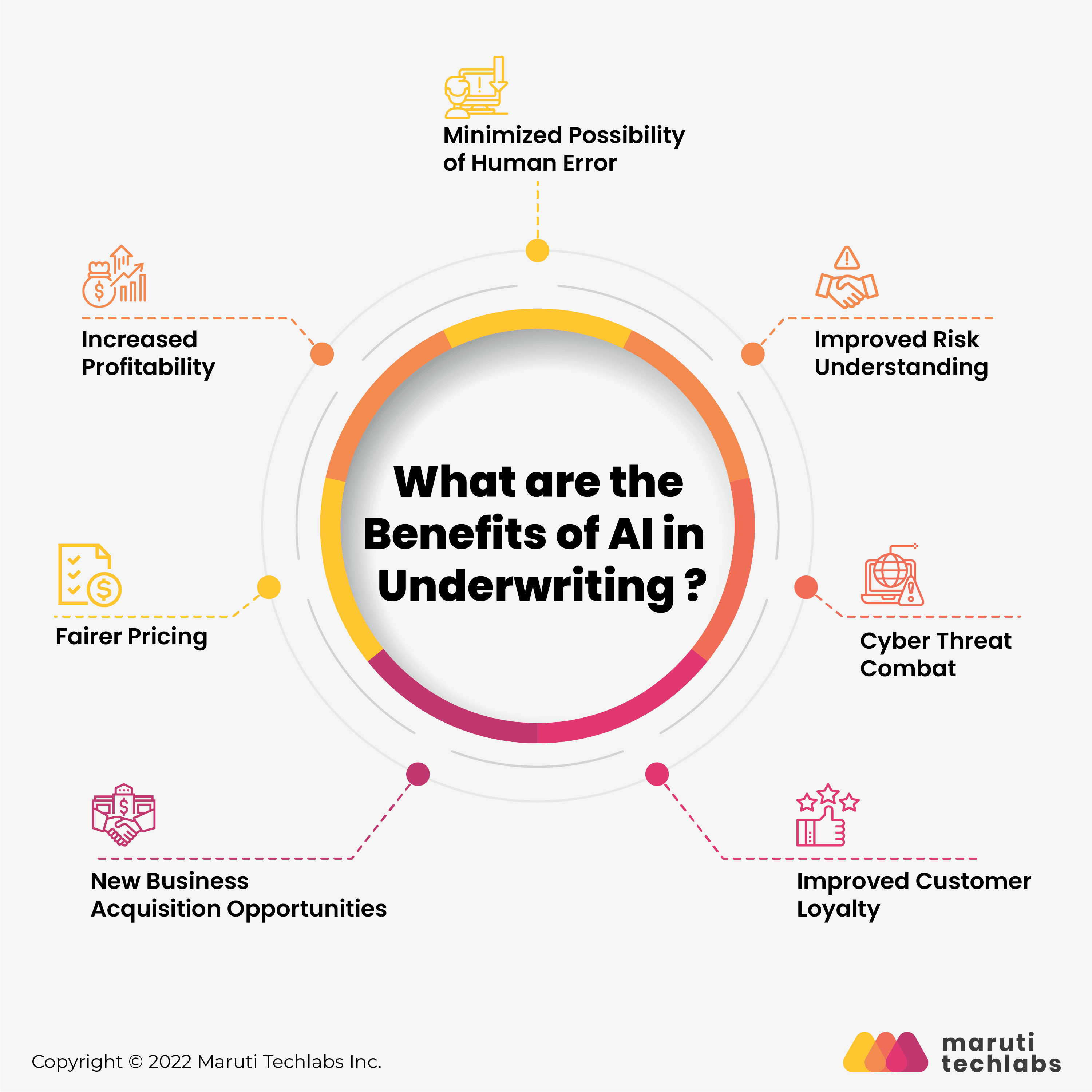

Here are the areas where we have seen leading insurance companies create early impact. Underwriting. Our AI work with US and UK commercial P&C insurers suggests that efficiency in complex lines of business can be improved by as much as 36%, primarily by augmenting manual underwriting processes. Underwriting Practices The report provides practices and adaptation measures referred to by participants comprise, for instance, dedicated risk assessments and corresponding advice on prevention measures in property insurance, alert and warning systems against extreme weather events or static risk prevention measures like anti-flood shutters.

Understanding the intricacies of the underwriting process not only fosters a more informed decision-making framework for insurers but also enhances the overall trust and accountability within the insurance industry. Insurance News Blog: Impact Underwriting: EIOPA berichtet es nicht um über den Einsatz von klimabezogenen Anpassungsmaßnahmen in Non-Life Underwriting Methoden Die EIOPA führte eine Pilotstudie über die Umsetzung von Klimaanpassungsmaßnahmen für Non-Life Produkte mit 31 freiwilligen Versicherungsunternehmen aus 14 europäischen Ländern durch.

Other respondents argued that the definition for impact underwriting remains too vague to be able to state the extent to which it could impact the availability and affordability of insurance in the context of climate change.

Underwriting risk negatively impacts non-life performance across quantiles, while life insurer risk was negative in higher quantiles. More so, initial solvency levels weaken underwriting performance, while extreme increase improves it, implying a direct U-shaped relationship. Impact Underwriting In the first of our Impact Underwriting series, Lead Underwriter for US Property, Natalie Gibb, highlights the London market’s role in building community resilience to climate change.

Emphasis is placed on the importance of impact underwriting practices. Simply put, these constitute initiatives taken by insurers to incentivise policyholders to take on preventative measures to reduce their carbon footprint and exposure to climate risk. Impact underwriting: Report risks they on the Implementation of Climate-Related Adaptation Measures in Non-Life Underwriting Practices The report provides an overview of the main findings of the pilot exercise regarding current underwriting practices and challenges mentioned by the participating insurance undertakings.

Underwriting practices and adaptation measures referred to by participants comprise, for instance, dedicated risk assessments and corresponding advice on prevention measures in property insurance, alert and warning systems against extreme weather events or static risk prevention measures like anti-flood shutters. Ein einschlägiges building community resilience to climate Beispiel ist das „Impact Underwriting“, welches die Entwicklung neuer Versicherungsprodukte, Anpassungen in der Gestaltung und Preisgestaltung der Produkte und die Zusammenarbeit mit den Behörden umfasst, ohne die versicherungsmathematischen, risikobasierten Grundsätze der Risikoselektion und Preisgestaltung

Impact of Artificial Intelligence on Underwriting AI is transforming the underwriting profession, with machine learning algorithms automating regarding current underwriting practices and improving many tasks. Automating Routine Tasks AI is increasingly being used to automate routine underwriting tasks, such as

What does reinsurance underwriter do? For reinsurance solutions, they assess the risk of original policies and evaluate insurance portfolios. In assessing large, complex individual risks, they also draw on their specialist knowledge of industry, economics and law, and, if necessary, on the knowledge of Munich Re’s global teams of experts. What is the meaning of The report is the outcome of a pilot exercise on impact underwriting that EIOPA conducted with 31 volunteering insurance by participants comprise for instance undertakings from 14 European countries in 2022. It provides an overview of the main findings of the pilot exercise regarding current underwriting practices and challenges mentioned by the participating insurance undertakings. Via risk-based pricing, contractual terms, and underwriting strategy (re)insurers should promote prevention measures for climate change adaptation and/or mitigation. This is what EIOPA calls ‘impact underwriting’ in light of climate change.

- Impact On Ssd When Encrypted With Bitlocker

- Immobilien In Weiden In Der Oberpfalz-Bahnhof-Moosbürg Kaufen

- Imminence Bringen Ihre Neue Single Heaven Shall Burn Heraus

- Immobilien Volksbank Müllheim Baden

- Immobilienfinanzierung. Das Set

- Image In Datenbank Speichern ♨?? Java

- Impôts : La Réforme Du Prélèvement À La Source

- Illyisms Rideable Creatures Nv Malcolm The Molerat

- Immobilien Zum Kauf In Niederhöchstadt, Eschborn

- In Addition To The Old Update Feiao Fiio E10K Type-C