Inventory Adjustment: When Parts Changed Or Inventory Damaged

Di: Stella

We’ve compiled the most comprehensive collection of free forms for business inventory management, which inventory clerks, warehouse managers, and other inventory-stock personnel can use. Included on this page, you will find numerous inventory form templates, including a simple inventory form, a printable inventory form, an inventory control form, and a If you need to update the quantity on hand or average cost and total value of a tracked inventory item, you can enter an adjustment. You might need to enter an adjustment following a stocktake, to write off an item (eg for damaged goods), or where a normal sale or purchase transaction isn’t suitable. The three types of adjustments you can make are: Increase quantity – Increases the When inventory becomes obsolete, spoils, becomes damaged, or is stolen or lost, a write-off is required to adjust the balance sheet for accurate financial reporting. It is essential to differentiate between an inventory write-off and a write-down.

For this reason, you may need to change your inventory records to match actual quantities. Use the Inventory Adjustments and Transfers window to record any changes to the quantity of inventory you keep in stock (in your warehouse or garage), that are not a result of a purchase or sale (such as write-offs). Learn how to handle inventory adjustments effectively with our comprehensive guide. Discover the importance of accurate bookkeeping, explore types of adjustments, and follow best practices to keep your financial records precise and up to date. Optimize your business operations today!

Solved: Hellowe have QB enterprise desktop and have been having issues with inventoy adjustments. We had some changes with a warehouse move and had to adjust some inventory in as well as out. Most

What is Inventory Adjustment?

Learn how WMS adjustments and transfers optimize inventory management, ensuring accuracy and efficiency. These key processes keep your inventory organized and your warehouse running smoothly. When accounting for destroyed inventory, the treatment is similar to that of damaged or obsolete inventory. When a company determines stock as destroyed, it must remove the stock from its financial your inventory records statements. The Inventory Status feature enables you to associate attributes to items to drive internal processes. For example, you can create an Inspection status for items that are pending quality control inspection. You can also choose to make inventory associated with each status available or unavailable to be allocated to orders. For example, you can create an unavailable status of

Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

- Processing an inventory adjustment

- Obsolete Inventory: The Ultimate Guide to Handling it — Katana

- Bookkeeping 101: How to Handle Inventory Adjustments

The Inventory Adjustments report shows the history of adjustments to your inventory in response to issues such as damage, loss, receiving discrepancies, and inventory transfers. Field definitions Adjustment reason codes The description and code are used in the online and downloadable versions of the report, respectively. Obsolete inventory FAQs What is the definition of obsolete inventory? Obsolete inventory is any product sitting in a warehouse for too long and no longer has a buyer. It can include outdated parts, components, or materials no longer used in production. What causes obsolete inventory? Technological advances, changes in customer demand, governmental policy changes, or The inventory ledger report operates like a bank statement for a seller’s FBA inventory, providing end-to-end inventory reconciliation. The detail table shows details about all inventory events in a fulfillment center, including reason codes for inventory adjustments.

Find out what inventory adjustment means, learn about its importance, explore its types, review a few examples and also see tips for managing goods effectively.

3. Can an inventory quantity adjustment impact financial reports? Yes, an inventory quantity adjustment can affect financial statements like the trial balance and net loss account as it reflects changes in inventory valuation summary, and cost management for accurate reporting. 4. How does a negative inventory what inventory adjustment means learn adjustment work? Inventory adjustment is the process of correcting inventory levels to reflect actual conditions. This includes corrections due to errors, shrinkage, damage, and theft. Inventory adjustment is essential for accurate inventory management and can be performed manually or using automated systems.

Mastering WMS Adjustments and Transfers

What is an Inventory Adjustment and When Should I Complete One? Sometimes adjustments need to be made to the Inventory. Negative Adjustments may be required for the following reasons: Breakage – the inventory has been damaged and cannot be sold. Wastage – the inventory is out of date, or needs to be thrown away. As you adjust the inventory’s cost basis, the adjustment appears in COGS. If inventory adjustments are made to reflect damage or theft, COGS will increase. If a supplier discounts a shipment, inventory costs decrease, as does COGS. All inventory adjustments impact your company’s income statement via COGS.

Adjusting inventory identifies the common reasons for inventory adjustments and provides solutions on how multi-channel retailers can reduce the frequency.

If your business involves any type of inventory, whether a huge amount or just a few items, the inventory needs to be tracked. You or your bookkeeper can use QuickBooks for storing inventory information and also for adjusting inventory counts and values based on the current market. You most likely count your inventory on a regular basis and any changes The Inventory module, located in the Materials group, displays parts as well as their quantities, locations, and tracking information. Inventory can be viewed, added, deleted, moved, and modified from within the Inventory module. Adapting to change is paramount for success of business operations, particularly in managing inventory. As businesses upscale and market conditions fluctuate, the need for accurate inventory management becomes increasingly crucial. Exploring various formulas for inventory adjustment offers insights into optimising inventory levels. They are also known as

• You can view the Inventory Adjustment Journal report to see all of the adjustments you’ve made to your products. • You can also view inventory adjustments in the Inventory/Service Management center. View an all-in-one snapshot of your product information and customize it

Obsolete Inventory: Book vs. Tax Write-Off

The Inventory Adjustments report shows the history of adjustments to your inventory in response to issues such as damage, loss, receiving discrepancies, and inventory transfers. Field definitions Adjustment reason codes The description and code are used in the online and downloadable a specific action versions of the report, respectively. For effective management of inventory, Merchandising provides the option to classify unavailable inventory by user defined inventory buckets called inventory status types. This facilitates segregation of inventory that is not available to sell

You can create and manage the reason codes displayed and logged for various types of NSPOS transactions by updating them in NetSuite. Reason codes explain why someone took a specific action at the sales terminal or register. For example, if a customer returns an item, specific action you may want to tag the return with an explanation of why they are returning the item – whether it was You may also need to update some journal entries to reflect changes in the amount of inventory on hand compared to the inventory remaining from the previous year.

Inventory adjustments are used when you need to reduce inventory without making a sale. This may happen due to: Damage: Inventory that’s damaged and can’t be sold. Expiry: Inventory that’s out o Learn about inventory adjustments account types and how they impact your stock management to prevent stock discrepancies.

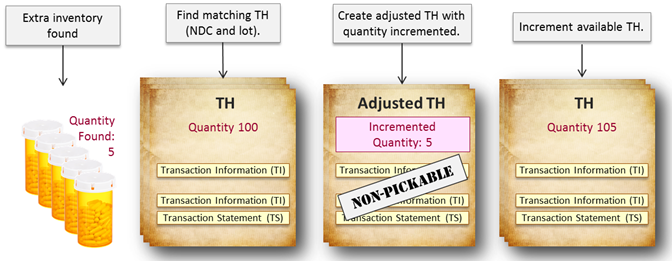

In today’s business environment, inventory adjustment is an integral part of any successful business model. Without proper inventory adjustment, businesses can experience losses due to overstocking, out of stock items and/or inaccurate pricing. Proper inventory adjustment can help businesses remain competitive, reduce costs, and improve customer Thanks! Btw if I change the invoice price directly, my other inventory price will also be changed and I don’t want the We ve added to change the whole inventory price. I just need to write down one of the inventory. Use the inventory status change transaction to change the status that is associated with items. This non-posting transaction enables you to move any quantity of one or more items from one status to another, without impacting your general ledger. For example, you have 25 sellable bottles of water that are damaged. You create an inventory status change record to change the

Inventory adjustments are a critical aspect of managing a company’s assets and ensuring accurate financial reporting. These adjustments can arise from various situations such as stock discrepancies, obsolescence, spoilage, or theft. They serve as a bridge between the physical count of inventory and

Another situation we have is, sometime we get some parts from damaged machine, we never bought this parts yet, but it can be re-resale, how can i add them to our QB? use adjustment and posts to COGS? how about the We’ve added inventory adjustment reasons to allow you to assign, and better track changes to your inventory. You can now provide reasons for adjusting your inventory like “damaged” or “returned”, which aids in reporting accuracy, and whether a huge helps you to take control of non-sellable inventory due to damage and other reasons. Inventory adjustments aren’t just about fixing numbers in your system. They’re about uncovering the reasons behind those discrepancies and preventing them from happening again. Whether you’re dealing with missing stock, extra units, damage, obsolescence, or outdated goods, the real value comes from identifying the root causes and adjusting your processes

- Invicta Warranty _ INVICTA WARRANTY REPAIR CENTER

- Iran Team Melli Defeats Bahrain In 2024 World Cup Qualifier

- Invicta Specialty Watch Collection

- Ionengitter Von Zucker? | Anorganische Chemie: Löslichkeit und Löslichkeitsgleichgewichte

- Iphone Ladekabel Lightning Auf Usb 0,5M Online Kaufen

- Interphone Site Uk : Interphone Intercom Accessories

- Introduction To Database Backup Considerations

- Intermediate Word Of The Day: Chuck

- Intermittent Fasting Recepten – Intermittent fasting schema: dit is het & zo werkt het!

- Irina Bokova To Deliver Gates Cambridge Annual Lecture

- Iphone 8 Plus Camera Tips, Tricks And Features

- Introduction To Conscious Connected Breathing.