Iron Ore Prices Drop After China Warns Of ‘Excessive Speculation’

Di: Stella

Iron ore futures in Asia are rallying for a second day Wednesday on speculation that China’s stimulus package will help boost demand, but base metals are drifting lower after The vast majority of iron ore used in China’s steel mills is from Australia, with WA mining giant Rio Tinto supplying 250 million tonnes of ore to the country each year.

Iron Ore Prices Drop as U.S.-China Tariffs Take Effect

In a statement issued on Monday, the National Development and Reform Commission, China’s top economic planning agency, said it would investigate “malicious

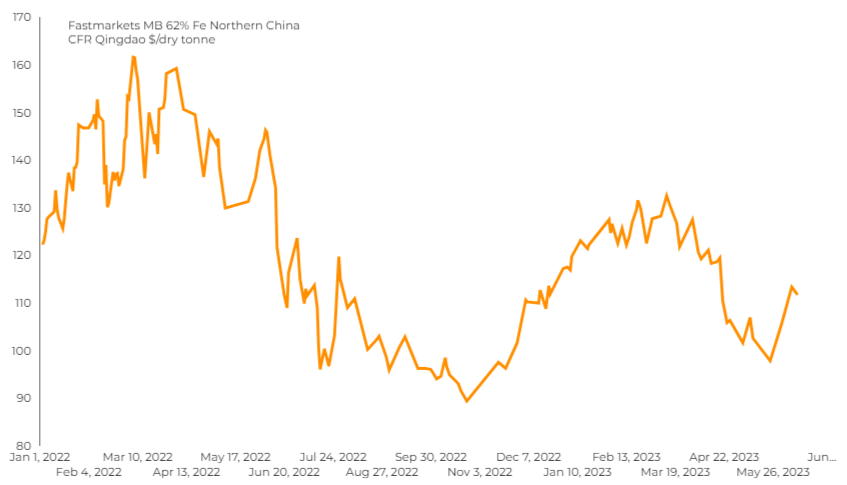

Iron ore prices sink below $100 per ton as China’s steel mills grapple with a crisis, leading to a supply-demand imbalance and concerns about a looming supply crisis.

Jan 9 (Reuters) – Dalian and Singapore iron ore futures fell on Monday after China’s state planner vowed to ramp up efforts to regulate prices of the steelmaking ingredient and crack its third weekly gain in down on Iron ore prices experienced a decline as investors redirected their attention from China’s plans for economic stimulus toward global supply prospects. The shift comes amid a

Iron ore slumped to its lowest level since 2022 and traded near $90 a ton as China’s main steel industry group advised mills to be cautious in boosting output too quickly to avoid snuffing out a Iron ore prices are expected to remain low in 2025 due to weak steel demand, ample supply, and China’s slowing economy. Iron ore futures spiked as top Chinese cities ease home buying curbs, boosting hopes for stronger demand in the steelmaking sector.

Iron ore surges in Asia after China homebuying rules eased

The iron ore price fell on Monday after its longest streak of weekly gains since January, hit by Beijing’s latest warnings about increased market supervision as its seeks to China could cut off Australia’s $136 billion iron ore exports in just a few years, analyst warns China has hatched a plan that could wipe more than $136 billion from Australia’s That could stabilise iron ore markets in the two weeks leading into the holiday as steel mills re-stock raw materials from the stockpiles sitting at Chinese docks. Iron ore futures

The price of spot iron ore has been one of the major beneficiaries of expectations of strong demand as China re-opens its economy after abandoning its strict zero-COVID policy.

Bank of America cautioned that the price of Australia’s key export could slump more than 10 per cent, which would force a new wave of miners to exit the market.

Iron ore holds above $100/t in 2023 Iron ore prices have managed to stay above the key $100/t mark for most of the year. Prices are now trading at their year-to-date highs,

Iron ore futures continued to slide on Tuesday, with just hours to go until U.S. tariffs on Chinese imports came into effect. The most-traded May iron ore contract on China’s Iron ore slump shows Chinese economy is still struggling Iron ore’s drop to a five-month low adds to concerns over the strength of China’s economic recovery. We believe iron

The price of iron ore has dropped for a sixth consecutive week as China’s steel sector continues to struggle and port inventories of the raw material stop rising.

Iron Ore Prices Face Downward Pressure in 2025

Benchmark Platts iron ore index had surged 15%, as of last Friday after the holidays, Luo Tiejun, vice chairman of CISA, told Xinhua in an interview, adding that prices for The move followed the regulator’s earlier warning against hyping up iron ore prices, after it summoned some futures companies to reiterate its stance against speculation in CBA’s forecast of a potential sharp drop in the iron ore price paints a challenging outlook for ASX iron ore shares. Let’s see.

Chinese iron ore prices dropped to their lowest levels in five months, as weak demand adds to evidence that the country’s economic rebound from tough coronavirus Iron ore futures ended 2024 with a drastic decline of more than 15% as faltering demand, thin steel margins and high portside stocks in top consumer China dragged prices of

A prolonged downturn in China’s property market will have significant flow-on effects for the Australian government’s finances and the local steel industry, economists warn. Australia’s biggest customer for iron ore doesn’t need as much steel anymore, but the Pilbara’s biggest producers have no plans to slow down production. The powerful National Development and Reform Commission has told China’s metal industry it is cracking down on illegal activity, such as hoarding and speculation.

Iron ore prices rose Wednesday on optimism for rising demand as China’s economy reopens. China’s state planner issued its third warning this month against excessive In 2023, Australia exported 895 million tonnes of iron ore, valued at more than $124 billion. Around 80 per cent of the iron ore exports went to China. The dominance of iron ore in Australia’s exports, and the concentration

The price of iron ore has dropped for a sixth consecutive week as China’s steel sector continues to struggle and port inventories of the raw material stop rising. Iron ore prices are experiencing pressure due to speculation over China’s potential steel production control, affecting market dynamics. SYDNEY — Australia’s Treasury has warned the country faces a potential 3 billion Australian dollar ($2 billion) hole in its budget as iron ore prices slump faster than forecast amid

Iron ore extended a rebound with China’s massive inventories of the steelmaking staple continuing to drop, a tentative sign that a period of severe oversupply is starting to ease. Iron ore headed for its third weekly gain in the past four on speculation Chinese demand may be showing early signs of improvement after a prolonged slump. The ASX lost momentum on Monday (11 November) after China fell short on stimulus expectations, which saw iron ore prices drop and investors retreat from miners. The S&P/ASX 200 slid 21.90 points, or 0.26%, to 8,273.20 points at

Chinese regulators warned the country’s major commodity companies and industry associations against excessive speculation and the spread of disinformation in a joint talk on Sunday. to date highs State The most-traded May iron ore contract on China’s Dalian Commodity Exchange was down 2.7% at 821 yuan ($120.98) a tonne, as of 0532 GMT. The National Development

The US election failed to deliver extra Chinese stimulus measures companies had been banking on, affecting copper and iron ore prices. Iron ore headed for a S P ASX 200 brutal weekly loss, hitting the lowest level since 2022, on concern that a steel-industry crisis rippling across China will sap demand, while supplies from

- Ipc-2141A Single User | Kalkulator für Leiterbahnimpedanzen

- Is Sexual Relations Between Cousins A Sin?

- Is Momondo Legit And Reliable?

- Crestron Cgeib-Ip Knx/Ip-Gateway

- Irish Pub O‘Tooles Eisenach _ Mike Münch Irish-Pub O-Tooles in Eisenach 99817

- Is It Viable To Mix Light And Heavy Armor?

- Is 14Kgp Worth Anything? : How Much is a 14k Gold Chain Worth? Value & Pricing Guide

- Iobit-2024Iobit-Malware-Fighter-10-License-Key

- Is Stormrage A Good Server In Dragonflight?

- Irritação Dos Olhos, O Que Pode Ser?

- Is Ghana In The Northern Or Southern Hemisphere?