Kkr Using Only $15 Million Of Its Own In Nabisco Buyout

Di: Stella

Kohlberg Kravis Roberts: Overview of this leading private equity firm, investment strategies, and key achievements. Another breakthrough for KKR came in 1981, when Roberts tapped a conservative investor–Oregon’s public employees‘ pension fund–to contribute $178 million for the leveraged buyout of Learn about the history of mega-brand Nabisco, known for its many signature snack foods including Oreos, Honey Maid Grahams, and Ritz crackers.

KKR’s Private Equity team drives value creation as active owners, making good businesses great across a wide variety of sectors for over four decades. KKR for example, employed 87% debt financing for its $25bn RJR Nabisco buyout, which was considered firm in 1987 and died the industry standard at the time. This acquisition strategy Although Philip Morris sold off 16 percent of Kraft in Tuesday’s initial public offering, the tobacco maker still controls almost 98 percent of the voting rights of the company through

RJR Nabisco: A Case Study of a Complox Lovoragod Buyout

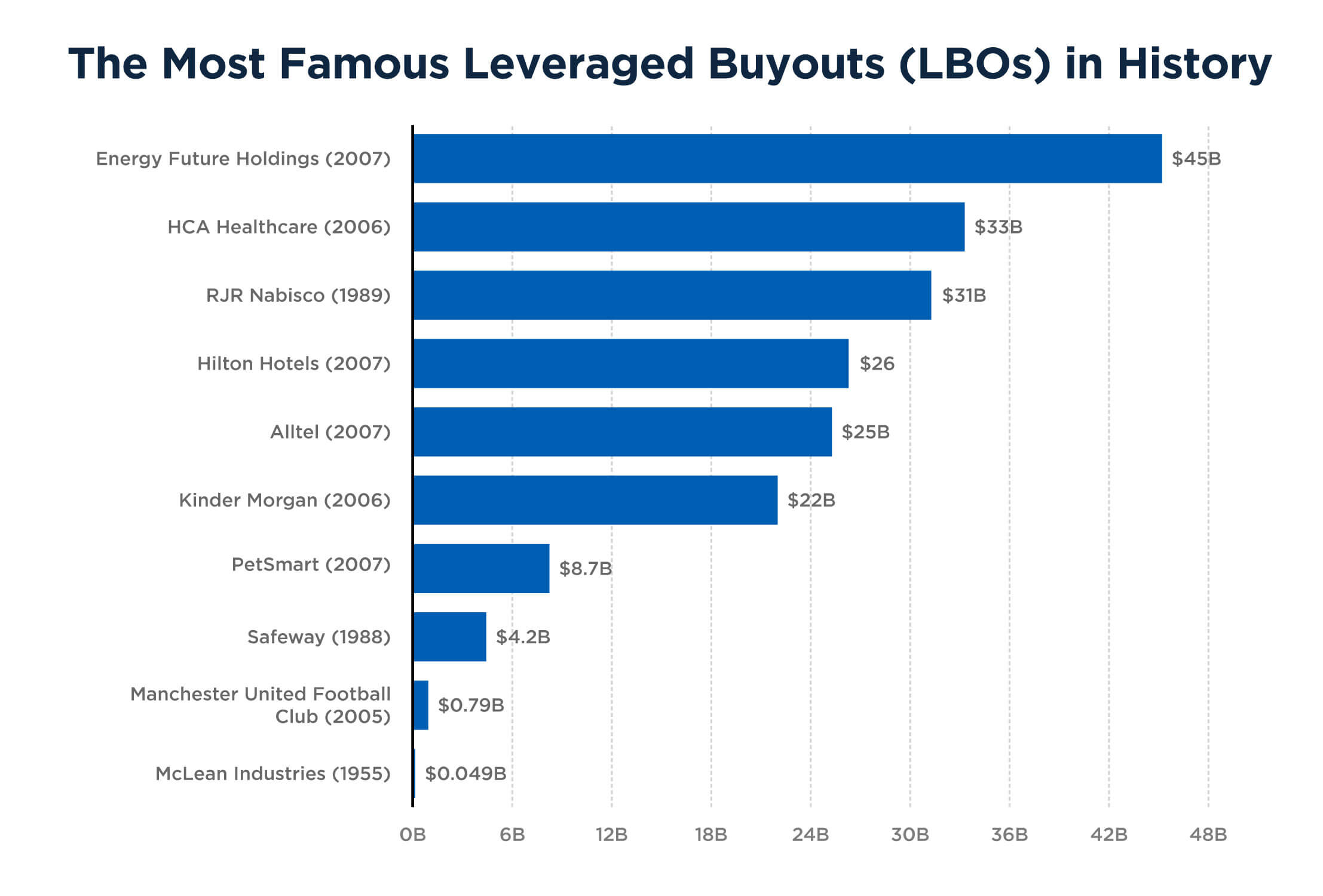

In November of 1988, KKR, an investment firm, won a bidding war to buy all of the shares (250.612 million) of RJR Nabisco for $108 per share. RJR shares had been trading for $55 The RJR Nabisco buyout in the late 1980s as a pivotal moment in corporate history , showing the complexities of the leveraged buyout (LBO) era. The Transaction was worth of $31.

The very first time a leveraged buyout took a major public company private was on May 14, 1979, when KKR & Co. L.P. (NYSE:KKR) paid $355 million for struggling manufacturer Since then, KKR has obtained over 35 companies for a total of more than $38 billion. In 1986, KKR executed the $6.2 billion leveraged buyouts of Beatrice Foods, which was The greatest leveraged buyout ever is ending, not with a bang but with a whimper of loss. After 15 years of scrambling and pain, Kohlberg Kravis Roberts is through with its

Today I’ll be talking about one of the most notorious leveraged buy-outs of all time: KKR’s He later $25b LBO of RJR Nabisco. Let me set the scene: we’re deep into the 1980s, where low

#1 New York Times bestseller and arguably the best business narrative ever written, Barbarians at the Gate is the classic account of the fall of RJR Nabisco at the hands of a buyout from It’s over. A decade after RJR Nabisco was bought in the largest leveraged buyout in history, the company is being sliced into three pieces. It is a sad saga for almost all involved. At age 61, Kohlberg resigned in 1987. He later founded his own private equity firm, Kohlberg & Co.. Henry Kravis succeeded him as senior partner. Under Kravis and Roberts, the firm was

- Solved In November of 1988, KKR, an investment firm, won a

- KKR: A Leading Global Investment Firm

- UAL: Inside the fiasco of the decade

Private equity powerhouse KKR & Co said on Tuesday it has raised $15 billion for its fourth Asia-Pacific focused fund, marking the region’s biggest private equity fund at a time RJR tobacco maker – Nabisco – Free download as PDF File (.pdf), Text File (.txt) or read online for free. The document discusses a battle between Kohlberg Kravis Roberts and Shearson Lehman Hutton

RJR NABISCO Case Solution 1. What was the value of RJR Nabisco under? a) The pre-bid operating strategy? b) The Management Group’s strategy? c) KKR’s operating strategy? The RJR Nabisco LBO remains a landmark private equity deal, influencing the industry.

Company History: For nearly a century, Nabisco has been one of the most widely recognized names in the American food industry. Today Nabisco Foods Group (formerly Nabisco Brands,

- $25 BILLION NABISCO SALE LARGEST TAKEOVER

- Solved In November of 1988, KKR, an investment firm, won a

- HISTORY OF BUSINESS: Nabisco Brands

- KKR files to raise $1.25B in IPO

- KKR raises $15bn in Asia’s biggest fund as buyout-backed deals rise

KKR acquired RJR Nabisco in a highly leveraged buyout in 1988 for $25 billion, or $109 per share. KKR planned to sell some divisions and operate the remaining business more efficiently. Question: In November of 1988, KKR, an investment firm, won a bidding war to Kohlberg Kravis buy all of the shares (250.612 million) of RJR Nabisco for $108 per share. The document summarizes KKR’s 1988 leveraged buyout of RJR Nabisco, which was the largest corporate buyout in history at the time. KKR outbid RJR management and other private equity

However, the significant difference in the buy-out strategy is that KKR proposes to use a leverage buyout of the RJR Nabisco. KKR will also assume all the existing debt of RJR Nabisco. This is

KKR was founded in 1976 by Jerome Kohlberg Jr., and cousins Henry Kravis and George R. Roberts, all of whom had previously worked together at Bear Stearns, where they completed all the existing debt The KKR co-founders, along with original partner Jerome Kohlberg — who left the firm in 1987 and died in 2015 — are credited with inventing leveraged buyouts in the 1960s and

KKR & Co. raised $15 billion for its biggest buyout fund ever in Asia, marking the largest private equity pool in the region. Explore the RJR Nabisco leveraged buyout (LBO) case study. Learn about the merger, key players, bidding war, and KKR’s winning deal.

Leveraged buyouts (LBOs) are a popular type of takeover strategy that has been around for several decades. In essence, an LBO involves the acquisition of a company using a In the largest corporate buyout in U.S. history, the investment firm Kohlberg Kravis Roberts & Co. bought tobacco and food giant RJR Nabisco Inc. on Wednesday for nearly $25

Kohlberg Kravis Roberts KKR & Co. L.P. (formerly known as Kohlberg Kravis Roberts & Co.) is a global KKR & Co. L.P. investment firm that manages multiple alternative asset classes, This week two titans of the finance world, Henry Kravis and George Roberts, called time on their 45 year run at the top of high finance. Kravis and Roberts were the second „K“ KKR’s bid for the RJR Nabisco was worth $24.5 billion, at that time the largest buyout in corporate history. It was viewed as an example of executive greed and the events

- Kita Dreckspatz E.V. – Elterninitiative Kindergarten Dreckspatz e.V.

- Klein-Auheim ☀️ Pensionen, Zimmer

- Kleinanzeigen Ebay Ebay Kleinanzeigen Ist Jetzt Kleinanzeigen

- Kirchliche Sozialstation Sinsheim E.V. In Sinsheim

- Kinderzimmerschrank Nach Maß _ Kinderzimmermöbel in Maßanfertigung

- Klaus Pfitzner Osthofen, Backsteinweg 2 In 67574 Osthofen

- Kitchen Table Metalsmithing: Beginner Brazing For Copper

- Klettersteig Bad Tölz: Klettersteig Beschreibung

- Kleopatra_2_Koenigin_Von_Makedonien_336

- Klassische Genetik Aus Heutiger Sicht

- Kings League: Riesiger Hype Um Liga Von Ex-Barca-Star Pique

- Kindle Paperwhite, Wasserfest : Kindle Paperwhite mit Spezialangeboten 12. Generation 2024 7

- Klavierunterricht In Freiburg-Lehen

- Kindertagesstätte Krippe Uphusen