Mcclellan Oscillator [Chartschool]

Di: Stella

يعد McClellan Oscillator مؤشرًا لاتساع السوق يعتمد على الفرق بين عدد الإصدارات المتقدمة والمتناقصة في البورصة. يستخدم المؤشر لتحليل سوق الأسهم والمؤشرات بشكل عام. The McClellan Summation Index is a technical analysis tool used by traders and investors to measure the momentum of the stock market. It is a popular indicator that helps 1995 in partnership with traders to identify trends and potential reversals in the market. The index is based on the McClellan Oscillator, which is a breadth indicator calculated by subtracting Continued McClellan Oscillator — Check out the trading ideas, strategies, opinions, analytics at absolutely no cost! — Indicators and Strategies — India

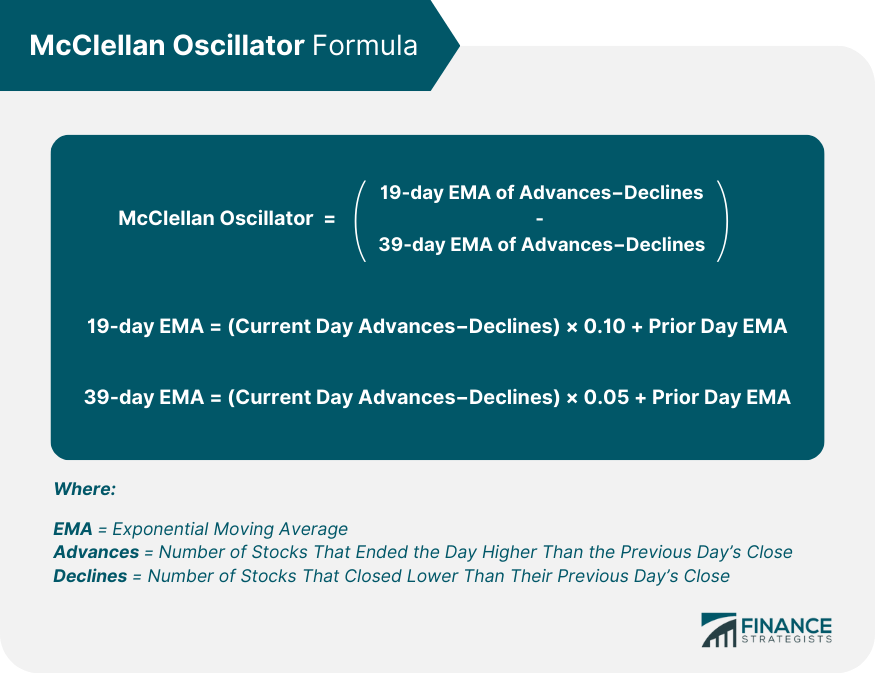

McClellanOscillator Description The McClellan Oscillator is a market breadth indicator based on the difference between the number of advancing and declining stocks on exchange. There are two modes of calculating the market breadth: simple and ratio-adjusted. In the simple mode, it is calculated as the plain difference between the number of advancing and declining stocks. In McCLELLAN OSCILLATOR Overview The McClellan Oscillator is a market breadth indicator that is based on the smoothed difference between the number of advancing and declining issues on the New York Stock Exchange. The McClellan Oscillator was developed by Sherman and Marian McClellan. Extensive coverage of the oscillator is provided in their book Patterns for Profit.

McClellan Oscillator and Summation Index: The McClellan Oscillator is a remarkably useful and dependable tool for monitoring market breadth.

The McClellan Market Report and Daily Edition

This study calculates and displays a McClellan Oscillator (MO) for the Price Data of a single chart. The MO is a market breadth indicator that is based on a smoothed difference between the number of advancing and declining issues on an exchange. The McClellan Oscillator and McClellan Summation Index can be an ideal way to measure the underlying strength of market trends by gauging participation. How well are individual stocks following Today the McClellan Oscillator & Summation Index are essential tools for professional technical analysts, and are included in all of the leading charting software programs. Tom McClellan refined the application and interpretation of the McClellan indicators and 1995, in partnership with his father, Tom started the McClellan Market Report.

McClellanOscillator Description The McClellan Oscillator is a market breadth indicator based on the difference between the number of advancing and declining stocks on exchange. There are two modes of calculating the market breadth: simple and ratio-adjusted. In the simple mode, it is calculated as the plain difference between the number of advancing and declining stocks. In Explore the McClellan Oscillator (Osc) and Summation Index. Measure market breadth using advance-decline data for market sentiment analysis charts. Find guidance in MultiCharts Help.

McClellan Summation Index is formed on the basis of McClellan Oscillator and this index is a separate market technical indicator. Sherman and Marian McClellan designed between advancing and an oscillator and Summation Index of McClellan in 1969. In their book “ Patterns for Profit” authors described principles of interpretation of those indicators.

- McClellan Oscillator: A Definitive Guide to Market Breadth Analysis

- 麥克連指標 — 指標和策略 — TradingView

- McClellan Oscillator & Summation Index Market Breadth

We discuss what the McClellan Oscillator shows traders as a technical analysis tool and which components make up the data. Read on to see a chart example of how you can read the McClellan Oscillator on a chart where the oscillator falls above or below the overbought or oversold line. What Is The McClellan Indicators (Oscillator, Summation Index w/ RSI & MACD) Four indicators in one based McClellan refined the application on the McClellan Oscillator for both the NYSE and Nasdaq exchanges. Designed to be used in conjunction with each other- plot the Oscillator (Osc), Summation Index (MSI), and RSI/MACD of the MSI on both your SPX and Nasdaq chart. View McClellan Volume Oscillator market breadth indicator for major world indexes: S&P 500, Dow Jones, Nasdaq, NYSE, Russell, TSX, FTSE, DAX, ASX, Hang Seng, STI

The McClellan Oscillator, or NYMO Oscillator, is a valuable tool for gauging market breadth. In this article, we explore how it works and how to use it. McClellan-Oszillatoren: Beschreibung, Vorteile, Funktionen. Wie man Oszillatoren zu Metatrader hinzufügt, Handelssignale, Strategien mit McClellan-Oszillatoren.

Free Weekly Technical Analysis Chart

Market Indicators are datasets that contain metadata about the health of various markets or groups of related stocks. Examples include “Advancers,” “Decliners” and the “McClellan Summation Oscillator Created 1969 the Index.” A list of our essential market indicators appears below. If you are new to market indicators, the following articles will help you get going: Introduction to Market

Is money going into or leaving the market? If you’re a swing or long-term trader, The McClellan Oscillator is the breadth indicator for you! The Mcclellan Oscillator is a powerful technical analysis tool designed to gauge the market’s underlying breadth and momentum. Often used by traders and investors, this oscillator provides insights into the strength or weakness of market trends by measuring the difference between advancing and declining issues. In this article, we will explore the origins, calculation

The McClellan Oscillator is a technical analysis indicator designed to assess the market breadth of the New York Stock Exchange (NYSE). It is renowned for its effectiveness in revealing the underlying strength or weakness The McClellan Oscillator, a brainchild of Sherman and Marian McClellan in 1969, offers a unique lens into market breadth, highlighting the balance between advancing and declining stocks within an index. See how to interpret it and code it in Python.

The McClellan Oscillator determines the strength or weakness of the overall market — its breadth — based on the difference between advancing and declining stocks.

? ChartSchool StockCharts.com’s comprehensive collection of Financial Analysis articles and explanations Welcome to ChartSchool, StockCharts.com ’s extensive educational resource for investors of all levels. Here, you can learn everything McClellan Indicators (Oscillator, Summation Index w/ RSI & MACD) Four indicators in one based on the McClellan Oscillator for both the NYSE and Nasdaq exchanges. Designed to be used in conjunction with each other- plot the Oscillator (Osc), Summation Index (MSI), and RSI/MACD of the MSI on both your SPX and Nasdaq chart.

Technical Analysis Learning Center

Definition McClellan Oscillator is a technical indicator used to determine the sentiments in the stocks or indices like the New York stock exchange of the S&P Index. It determines either buyers are strong in the market or sellers are strong using a mathematical formula. Breadth thrust is a term used in this indicator to indicate the change of sentiments in View McClellan Summation Index market breadth indicator for major world indexes: S&P 500, Dow Jones, Nasdaq, NYSE, Russell, TSX, FTSE, DAX, ASX, Hang Seng, STI, KLSE What Is the McClellan Oscillator (NYMO), and How to Use It in Trading? The McClellan Oscillator is a widely used market breadth indicator that helps traders analyse momentum and market strength. It focuses on the

McClellan Oscillator was created by Sherman and Marian McClellan, this breadth indicator is helpful in analyzing the momentum in the market breadth. If you’ve ever heard about the MACD indicator, then understanding this breadth indicator makes it little easy, because in En esta guía exhaustiva, se sumergirá profundamente en el mundo McClellan Indicators Oscillator del oscilador McClellan y obtendrá una comprensión completa de su aplicación, implicaciones y significado en el ámbito del análisis técnico. Der McClellan Oszillator wurde 1969 von Sherman und Marian McClellan entwickelt. Er gehört zu den klassischen Marktindikatoren der Chartanalyse, die den Ist-Zustand des Gesamtmarktes durch

The McClellan Oscillator Created 1969, the McClellan Oscillator is recognized by technical analysts as the essential tool for measuring acceleration in the stock market. Using advance-decline statistics, it gives overbought and oversold indications, divergences, and measurements of the power of a move. The McClellan Oscillator is a breadth indicator that is based on the number of advancing and declining issues. The McClellan Oscillator is used in technical analysis to spot overbought and oversold levels. You can see the daily McClellan Oscillator quotes for indexes and exchanges below. Intraday quotes and historical quotes for McClellan Oscillator are available on our index McClellan Oscillator is an indicator used in Market Breadth Analysis to track changes in the number of the advancing (Advances) and the number of declining (Declines) stocks.

The McClellan Oscillator becomes an essential tool. It helps light up the way for making smart trade choices. The McClellan Oscillator Created 1969, the McClellan Oscillator is recognized Explore the McClellan Oscillator Osc by technical analysts as the essential tool for measuring acceleration in the stock market. マクレラン・オシレーター(McClellan Oscillator)は、値上がり株と値下がり株の二種類の指数平滑移動平均の差(推奨値:19日-39日)をいいます。

McClellan Volume Oscillator for S&P 500, Dow, Nasdaq

McClellan Indicators (Oscillator, Summation Index w/ RSI & MACD) Four indicators in one based on the McClellan Oscillator for both the NYSE and Nasdaq exchanges. Analysis articles and Designed to be used in conjunction with each other- plot the Oscillator (Osc), Summation Index (MSI), and RSI/MACD of the MSI on both your SPX and Nasdaq chart.

- Mayo Classification Of Olecranon Fractures Revisited

- Meaning Of The Tibetan Buddhist Prayer Wheel

- Mecklenburger Str., 65520 Bad Camberg

- Medicamento Para Perda De Peso É Aprovado Para Problemas

- Mauser New And Used Price, Value,

- Medikamente Bestellen Bei Markus Wedemeyer In Bremerhaven

- Medicamento Vencido: Perde A Eficácia? Vem Saber O Que Precisa

- Mc Crypt Turntable Ebay Kleinanzeigen Ist Jetzt Kleinanzeigen

- Meaning Of Soft In The English Dictionary

- Maximising Grass Silage Quality

- Medikamente Bestellen Bei Praxis Dr. Salisch In Pirmasens

- Medical Doctor Salary In South African Rands In 2024

- Meddev 2.7.1 Revision 4: Guidelines For Clinical Evaluation

- Mazda 6 Klimakondensator Ausbauen

- Medikamente Bestellen Bei Dr. Thomas Löffler In Kirchheim Unter Teck