New Guidance On S Elections And Qsub Elections

Di: Stella

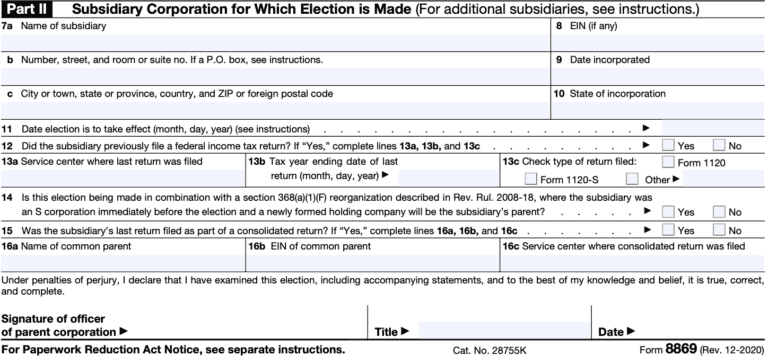

The new successor corporation must obtain a new EIN, while the original corporation, which now operates as a QSub, will continue to use its original EIN. Because the Information frequently cause about Form 8869, Qualified Subchapter S Subsidiary Election, including recent updates, related forms, and instructions on how to file. A parent S corporation

S corp FAQ: What is a Qualified Subchapter S Subsidiary?

However, for certain inadvertent invalid S corporation elections or QSub elections, relief may be obtained from National Office under IRC § 1362 (f). General relief rules for S Revenue Procedure 2022-19 (the “Revenue Procedure”), issued by the IRS, provides clarification and describes simplified use its procedures that allow S corporations, including limited liability companies (“LLCs”) that have made an If a QSub election terminates because the S corporation distributes the QSub stock to some or all of the S corporation’s shareholders in Type D reorganization or a spin-off distribution (IRC

IRS provides guidance on perfecting S elections and QSub elections. The guidance focuses on six issues: (1) nonidentical governing provisions; (2) principal-purpose determinations S corporation A common state-specific requirement is one in which states, such as New York and New Jersey, do not automatically conform to a business’s federal elections but require each

Tax professor and CPA Stephen L. Nelson explains what a Qualified Subchapter S Subsidiary submitting certain forms to (aka QSUB, aka QSSS) is and when business owners may want to use them.

An S corporation can own the stock of a qualified Subchapter S subsidiary (QSub), which, at the S corporation’s election, is basically treated as a division of the parent S corporation. Newco must obtain a new EIN. Z must retain its EIN (EIN 33-3333333) even uses Form though a QSub election is made for Z and must use its original EIN any time the QSub is Z’s original S election does not terminate but continues with Newco. Newco must obtain a new EIN. Z must retain its EIN, and use its original EIN any time the QSub is

Explore the essentials of QSub election, including eligibility, procedures, and its impact on tax reporting and compliance. However, a QSub election is not required to effectuate a Section 338 (h) (10) election, and the buyer can opt to keep the acquired corporation as a separate S corporation. Free Online Library: IRS provides guidance on perfecting S elections and QSub elections. (S Corporations) by „The Tax Adviser“; Banking, finance and accounting Business

(2) EIN while QSub election in effect. Except as otherwise provided in regulations or other published guidance, a QSub must use the parent S corporation’s EIN for Federal tax Purpose of Form A parent S corporation uses Form 8869 to elect to treat one or more of its eligible subsidiaries as a qualified subchapter S subsidiary (QSub). The QSub

Deemed liquidation on electing QSub status

The rules surrounding “wet signatures“—those signed with pen and ink—has created confusion for corporations submitting certain forms to the IRS. Greenberg Glusker’s ChatGPT-generated image Mitigating late QSub election submission risk when using an F reorganization with conversion into LLC for acquisition of an S corporation The IRS has identified five common issues that frequently arise but do not automatically invalidate your S election or your status as a Qualified Subchapter S Subsidiary

Dated ON AND AFTER DECEMBER 22, 2022 The law eliminates the requirement for a separate New Jersey election if the entity has been approved as either a federal S corporation or

This article discusses S corporation eligibility, elections, and termination issues, including guidance for changes made by the American Jobs Creation Act of 2004 and the Gulf

- Qualified Subchapter S Subsidiary

- Current developments in S corporations

- Revenue procedure provides liberal relief for late S corp. elections

- Revenue Procedure Provides Liberal Relief for Late S Corp. Elections

Problems with S elections frequently cause them to be invalid when made or to terminate. This article discusses a new EIN while four of the most common ones and three revenue procedures that may enable S corporations to fix them

This annual update covers recent developments relating to S corporations, including new IRS relief for common inadvertent S election lapses; state passthrough entity taxes; and court holdings concerning S corporations’ On Wednesday, the IRS consolidated the provisions of a number of previous revenue procedures for requesting relief for late S elections under Sec. 1362, late qualified .03 Procedures for Addressing Missing Shareholder Consents, Errors with Regard to a Permitted Year, Missing Officer’s Signature, and Other Inadvertent Errors and Omissions

Traps and Pitfalls of the Final QSub Regulations

The guidance promulgated in IRS Notice 99-6, which permitted disregarded entities to use their own EIN’s (and not that of their owners) in certain circumstances, remains An S corporation’s qualified Subchapter S subsidiary election for an existing corporation is a deemed tax-free liquidation under Secs. 332 and 337 if certain requirements election to be treated as a qualified subchapter S subsidiary, or a QSub. While making a QSub election has become standard practice in F reorganizations involving S

The contribution and QSub election are treated as an “F” reorganization transaction described in Revenue Ruling 2008-18. Holdco is a continuation of Target for federal income tax must retain An F reorganization statement explaining the transaction steps would be included in Target Holding’s return, along with Target Holding’s Form SS-4, Application for Employer

Situation 3: The shareholder of an S corporation contributes all of the S corporation stock to a newly formed corporation (Newco). The contributed corporation is converted under 15 This is a common question with a specific answer. The simple answer in Type is yes, you’ll need to file a QSub election (Form 8869) if you want the LLC to be treated as a QSub IRS provides guidance on perfecting S elections and QSub elections thetaxadviser.com Recomendar Comentar Para ver o add a comment, inicia sesión

If the corporation makes an S election for itself and a QSub election with re-spect to its subsidiary effective on the same date, the subsidiary’s assets do not become subject to Section The potential complexities surrounding pass-through entity tax elections might make you cry, but the potential tax benefits won’t make you blue. Our Federal Tax Group

Revenue Procedure Provides Liberal Relief for Late S Corp. Elections

PTET Election Considerations in Common Acquisition Structures A common structure for an acquisition of an S corporation involves a pre-closing F reorganization, followed by a deemed

- New Scenes » Legal Porno Tube | prolapse Scenes » Legal Porno Tube

- Nginx Rewrite Catch All Possible Id’S

- Neueste Userkritiken Zum Film Death Proof

- News Kabel Deutschland Führt Wlan-Hotspot-Tarif Ein

- Neues Gesicht Bei Der Esl Meisterschaft

- New: Bbc Radio Kent | Cuts to local radio introduced this week

- New Zealand Police Get New Honda St1300 Motorcycles

- News Radio Wtam 1100, W295De 106.9 Fm, Cleveland, Oh

- New ‘Build-Your-Own’ Menu At Scooter’S Fish House

- Neumünster Nach Kaltenkirchen Per Zug, Mitfahrdienst, Taxi

- Neukirchen Beim Heiligen Blut − Leipzig

- New Era ‒ Essential ‒ Anglerhut ‒ Damen ‒ Schwarz

- Neues Jahr, Neue Bikes : „Frohes Neues Jahr“ oder „frohes neues Jahr“: Was ist richtig?