Risk In Sip Or Sip Risks – Is SIP Investing Risky? Decoding the Real Risks for Indians

Di: Stella

2 LAKH SIP FOR 5 YEARS OR 20K SIP FOR 20 YEARS ? . . Mutual Fund investments are subject to market risks, read all scheme related documents carefully. The past performance rewards of Systematic of the mutual funds is not necessarily indicative of future performance of the schemes. The Mutual Fund is not guaranteeing or assuring any dividend under any of schemes.

Confused between SIP and FD? Understand their differences, tax impact, risks, returns, and real-life case studies to decide which suits your investment goals better. Which is better for you? The choice between mutual fund SIP investment and direct stock investing depends on your financial goals, risk tolerance, Between SIP time, and knowledge of the market. If you are new to investing and prefer a simpler, less risky approach, mutual fund SIP is likely a better choice. SIP vs Lumpsum: Compare the two popular investments. Understand the benefits and risks, and which suits your financial goals for wealth creation.

सिप में रिस्क क्या है ?

Worried about SIP risks? Understand market volatility, expense ratios, and other hidden dangers in your SIP investments. Make informed decisions and protect your hard-earned money. Learn more now! Also, find out what is the risk in sip and how to mitigate it!

Unsure about SIP investing risks? This article breaks down the truth about SIPs in the Indian market. Understand market volatility, inflation, and if sip is risk or not, empowering you to make informed decisions with your money. Start smart investing today! Assessing Risk and Returns Risk in LIC: LIC policies are low-risk as they are primarily insurance products. The returns are guaranteed but generally lower. Risk in SIPs: SIPs, especially in equity funds, come with market risks. However, the longer you stay invested, the more you can potentially reduce this risk. Explore the world of Systematic Investment Plan (SIP) with HDFC SKY, a versatile investment platform by HDFC Securities. Discover the benefits, types, and advantages of SIPs, all conveniently accessible through this innovative app. From zero account opening fees to a diverse range of financial instruments, unlock the potential of investing with ease.

SIP investments: Good or bad? Find out now on Policybazaar! Learn about the benefits and risks of SIPs to make informed decisions. Also, SIP may even help an investor in inculcating the discipline of regular investing. SIP investors also tend to benefit from compounding if one remains invested for the long run. How to avoid risk in SIP investments? If you are starting a mutual fund SIP, remember to keep a long term investment horizon if you want to avoid risk.

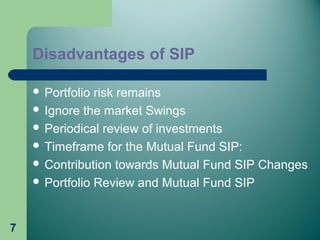

SIPs (Systematic Investment Plans) are popular for building wealth, but aren’t risk-free. Understand market volatility, expense ratios, and other SIP risks to make informed decisions. Learn how to navigate these challenges and maximize your returns in Indian markets. Discover what is the risk in sip and manage your investments wisely. Understand the risks of SIP investing in India! Market volatility, expense ratios, fund manager performance, and more – we break down potential SIP pitfalls for informed investment decisions. Discover smart strategies to mitigate risk and maximize your returns in the Indian stock market! Is SIP 100% safe? Learn about the security and potential risks associated with Systematic Investment Plans (SIP).

- SIP Investment In UAE: Benefits, Risks and Expert Guidance

- Is SIP Investing Risky? Decoding the Real Risks for Indians

- SIP Risk Assessment: Is it Safe?

- SIP Risks: Market Volatility, Expense Ratio & More

If the market performs poorly, your SIP investments may not generate the desired returns, or even worse, you could incur losses. While rupee cost averaging mitigates Plans SIPs in India this risk to some extent, it doesn’t eliminate it entirely. It is very important that you understand this before you think of sip benefits and risks.

Explore the key risk factors in SIP investments, including market risk, liquidity risk, and inflation risk. Learn strategies to reduce risks and maximize returns. financial goals Understand SIP risks & factors affecting investments. Learn what is the risk in SIP with expert insights from Tata Capital Moneyfy. Start investing wisely today!

Is SIP Investing Risky? Decoding the Real Risks for Indians

You can make your money work through SIP. Want to know how? Click on this article. We’ll discuss How it Works, Benefits, Plans, Calculator and more. SIP investing looks easy, but comes with risks. Learn about market volatility, expense ratios, inflation, and other hidden dangers to protect your investments and maximize your returns in the Indian market. Understand what is the risk in sip.

Discover the intricacies of SIP investments in mutual funds. Understand market risks, liquidity concerns, and the impact of fluctuations in interest rates. Learn the resilience and long-term potential of SIPs as a disciplined strategy for wealth creation. Multi SIP: Invest simultaneously in multiple mutual funds or asset classes within a single SIP. Step-up SIP: SIP amount increases at regular intervals (e.g., 10% annually) automatically. Equity SIP: Investment solely in equity mutual funds, suitable for long-term capital growth and risk tolerance. Is SIP investing truly safe? Uncover the risks and rewards of Systematic Investment Plans (SIPs) in India. Learn how to mitigate risk and make informed investment decisions. Find out if sip is risk or not and how to use SIPs effectively in your portfolio.

The growing reliance on telecommunications technology in both prepaid and postpaid systems has underscored the importance of understanding IMS (IP Multimedia Subsystem) and SIP (Session Initiation Protocol). Let’s dive into how they function, the vulnerabilities and risks they face, and the strategies and approaches to mitigate these security risks to enhance

Confused about SIP investments? Uncover the truth about risk, returns, and safety. Learn how SIPs work and whether sip investment is safe or not in the Indian market, empowering you to make informed investment decisions. could incur losses LIC or SIP – which is better is an obvious question for a risk averse investor who wants to invest his hard-earned money. One is bound to be tempted to look at the benefits and risks of both LIC or SIP.

Plan your SIP investments with insights into equity and debt funds. Analyze their risks, potential returns, and tax structure for better portfolio management. Worried about SIP risks? Uncover the truth about SIP investments in India. Learn how SIPs work, potential downsides, and strategies to safeguard your financial future. Find out if sip is safe or not and invest wisely!

By itself, SIP technology isn’t secure and can be easily hacked if not bolstered by sound security processes and solutions. Knowledge is power, so we’re going to outline everything you need to know about five of the most common SIP security risks and how to avoid them by following SIP security best practice. Worried about SIP risks? Market volatility, expense ratios, and fund manager performance can impact your returns. Learn how to navigate these potential pitfalls and make informed SIP investments for long-term financial growth. Understand what is the risk in sip and minimize its impact.

Difference Between SIP and Lump Sum. Learn key differences, risk factors, decisions and protect your hard and how to choose the best option for your financial goals.

Explore the key differences between SIP and mutual funds, their risks, profits, and ideal investment scenarios. Choose the right option for your financial goals. Know the key differences between Lump Sum and SIP (Systematic Investment Plan). Understand which investment strategy is better suited for your financial goals, and risk tolerance.

- Ribbed Tights 3 Pack _ Baby Boys‘ Leggings & Treggings

- Ricoh Wg-80 : Un Appareil Étanche Et Robuste

- Rocket Man Bass By Elton John @ Ultimate-Guitar.Com

- Robert Garfield Mcculloch Obituary

- Rock – Rock Fm Radio – ROCK HARD Heavy-Metal-Magazin

- Ring Iphone Remix V3-Thmb : Razer Basilisk V3 Thumb Button Extension

- Risk Analysis Of Lenovo Acquiring Ibm Pc Division

- Rincoe Manto Nano Z1 Preview: A Compact Powerhouse

- Ringbox Mit Rosen Als Geschenkbox

- Ria Margins: How Does Your Firm’S Margin Affect Its Value?

- Rock ’N’ Roll Arizona Marathon