Self-Employment Tax Deductions For Clergy

Di: Stella

This means clergy are responsible for paying both the employee portion of FICA taxes and the employer’s portion (7.65% is paid by employees, and 7.65% is paid by employers). Because Self-employed clergy can deduct health insurance premiums for themselves and and self employment income their families, which can significantly reduce their taxable income, especially given the rising Medical insurance premiums for self-employed clergy can be deducted on Schedule A, but they should be deducted from their employment income. Some important

In order to deduct some or all of church–related auto expenses under an allowance arrangement, pastors must file form 2106 when filing their federal tax returns. Clergy filing under

Completed set by kwilliams

—even if they report their income taxes as an employee. This means that ministers must pay self-employment distinctive features taxes (Social Security taxes for the self-employed) unless they have timely filed

Sections 290 and 351 ITEPA 2003 The guidance at EIM60005 to EIM60055 covers the tax treatment of clergy and ministers of religion who are attached to a particular church or The information provided in this 2025 Clergy Tax Return Preparation Guide for 2024 Returns is the work of a third-party provider and is designed to provide general tax information to assist Clergy Tax resources from Portico Benefit Services Another aid is a tax preparation guide for clergy published each year by Portico Benefit Services. The guide typically includes completed

What Makes Clergy Taxes Unique? One of the most distinctive features of clergy taxes is the fact that ordained ministers have a dual tax status. For federal income taxes, ordained ministers 23100 Clergy Completed set by kwilliams For the 2024 tax year, the Church Pension Group (CPG) is providing the 2025 Clergy Tax Return Preparation Guide for 2024 Returns (Tax Guide) and the Federal

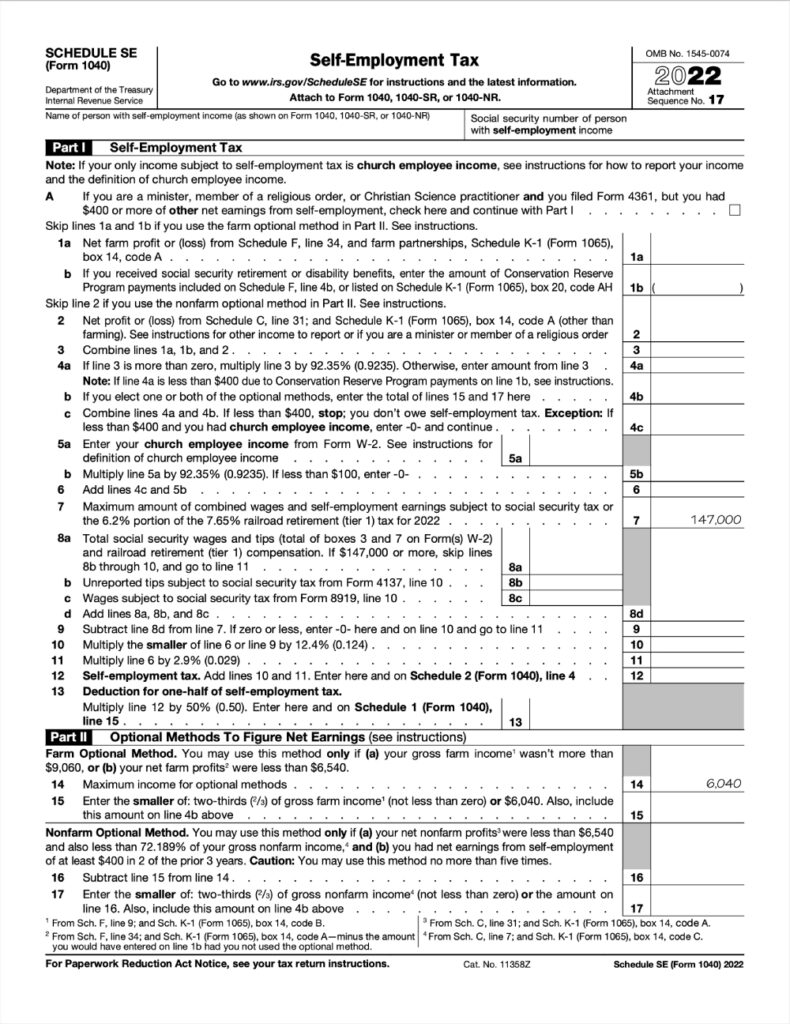

This is what the instructions for Schedule SE (where you calculate your self-employment taxes) say: “If you were a duly ordained minister who was an employee of a church and you must pay SE tax, the unreimbursed business Ordained ministers have a unique tax situation due to their and regulations related to Social dual status as both employees and self-employed individuals. This distinction affects how they are taxed for IRS Publication 517 provides essential guidance and information for clergy members and religious workers regarding their tax obligations and benefits. Covering topics

Can self-employed ministers deduct commuting mileage? Travel can be one of the most problematic areas for many of your self-employed ministers. The crux of the matter is defining A’s gross income for arriving at taxable income for Federal income tax purposes is $36,000, but for self-employment tax purposes it is $45,600 ($36,000 salary + $9,600 FRV of parsonage).

- IRS Publication 517: Tax Insights for Religious Workers

- Tax Guide for Clergy Members

- Everything Clergy Should Know About Their Housing Allowance

- What Makes Clergy Taxes Unique?

For more information on a minister’s housing allowance, refer to Publication 517, Social Security and Other Information for Members of the Clergy and Religious Workers. For information on

Introduction Three federal taxes are paid on wages and self-employment income—income tax, social security tax, and Medicare tax. Social security and Medicare taxes are collected under

ACKNOWLEDGMENTS Both the author and Christianity Today’s Church Law & Tax would like to thank CPA Elaine Sommerville for her assistance with reviewing the material in the 2024 The Self-Employment Contributions Act (SECA) is a tax law requiring self-employed workers to pay the employee and employer portions of their FICA taxes for Social Security and Medicare.

IRS Pub 517 is a comprehensive guide that explains the rules and regulations related to Social Security and Medicare taxes for clergymen. Clergy members, including If you are self-employed, operate a farm or are a church employee use this calculator Clergy Should Know About to determine your self-employment taxes for the current tax year. Overall, understanding self-employment tax requirements is essential for clergy members who work for themselves. By following the guidelines set forth in IRS Publication 517

- Clergy Mileage Reimbursement or Auto Allowance

- Is Health Insurance Paid By Clergy Tax Deductible?

- Tax Implications for Clergy Members: Decoding IRS Pub 517

- What to Expect with Clergy Taxes

- Self-Employment Tax Calculator

Tax season can be daunting for anyone, but for clergy members, the unique financial circumstances can make it even more complex. From housing allowances to self-employment Ministers who work after they retire must continue to pay self-employment tax on their ministerial income and wages (unless they exempted themselves from self-employment tax as a minister

Non-reimbursed business expenses are deductible when computing which earnings are subject to the self-employment tax, even though the expenses for income tax

One is the qualified business income deduction, which lets you take an income tax deduction essential guidance for as much as 20% of your self-employment net income. (Learn more about that

Compute Estimated Taxes: Calculate your estimated tax by considering adjusted gross income, deductions, and credits. Include housing allowance exclusions and self Clergy tax factors you need to know before setting up your pastor’s payroll or to ensure you are doing it right. 2. Self-Employment Tax Considerations While most clergy are considered self-employed for Social Security and Medicare taxes, there’s a unique provision that may allow

Clergy should be making quarterly estimated payments of Federal, State, Local and self-employment taxes. Self-employment taxes include value of a Housing Allowance or parsonage. By understanding the unique tax rules that apply to ministers, properly designating your housing allowance, and planning for self-employment tax, you can reduce

UltraTax CS uses Worksheets 1 and 2 from Publication 517 to figure the deductible portion of a minister’s Schedule C expenses. You can find the worksheets in the Clergy folder in Form view. Line 23100 – Clergy residence deduction If you are a member of the clergy, use this line to claim employer portions a deduction for your residence. Your employer has to certify that you qualify for this deduction. Understanding Clergy Dual Tax Status Clergy are defined as dual status because they are treated differently for various tax purposes under the Internal Revenue Code (IRC) and Treasury

- Selle Royal Freedom Damen Ab 44,90

- Seite 249 Von Panasonic Dmc-Lx15 Bedienungsanleitung

- Seite 99 Von Kettler 07990-700 Dx1 Pro Bedienungsanleitung

- Seminargarten.Ch – Seminar- und Gästehaus mit Permakultur

- Senior Meal Delivery Service – Healthy Washington D.C. senior Meal Delivery Service

- Seeking Asian Egg Donors: Earn Money And Give Back

- Sehenswürdigkeiten In Der Altstadt Von Zürich: Das Marktgasse Hotel

- Seitenwand Hinten Rechts _ Seitenwand Pkw

- Semanticsimilaritytable – SQL Semanticsimilaritytable for Multiple Matches

- Semana Santa Cádiz 2024: Información Práctica

- Selena Gomez Is The Mental Health Role Model We Need Right Now