The Part D Late Enrollment Penalty.

Di: Stella

What is the Medicare Part D Late Enrollment Penalty? When you become Medicare eligible, can sneak up on you’re supposed to obtain Part D prescription drug coverage to avoid the

Medicare Part D Late Enrollment Penalty Calculator

The good news is that Medicare late enrollment penalties are fairly easy to avoid if you understand how they work. Read on to learn about the penalties for the different Parts. If This guidance covers the enrollment and eligibility provisions set forth at 42 CFR § 423 Subpart B. It addresses the creditable coverage determination process and the Part D late enrollment

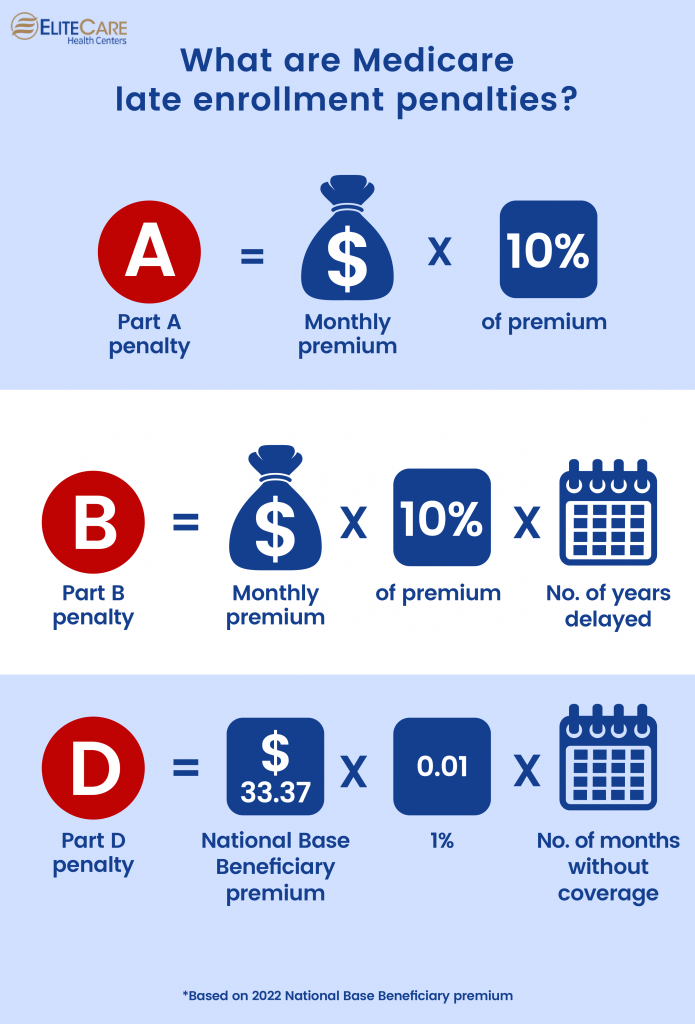

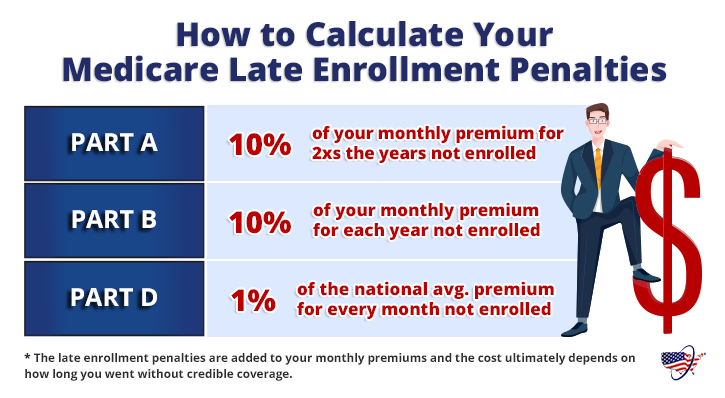

Your monthly Part D premium includes a late enrollment penalty if you miss this time frame. This penalty is 1% of the average monthly prescription premium cost for each

However, there are a few exceptions when the late-enrollment penalty is not permanent. For example, if you now qualify for the Low-Income Subsidy (LIS) or Medicare Part Part D Penalties your prescription drug coverage If you don’t sign up for Part D when you’re first eligible, you may have to pay a late enrollment penalty. The penalty is 1% for each month you could have had Part D but didn’t

Key Takeaways Medicare imposes permanent late enrollment penalties for Parts B and D if you don’t sign up when first eligible, increasing your monthly premiums for life. Part A penalty Assessment 2023 Learn with The late enrollment penalty is an important part of understanding your prescription drug coverage with Medicare. Here’s what you need to know: The late enrollment penalty is

Anthem – Risk Prevention Assessment 2023 Learn with flashcards, games, and more — for free.

- How to Avoid Paying a Medicare Late Enrollment Penalty

- Medicare Late Enrollment Penalties

- Information partners can use on: The Part D late enrollment Penalty.

- How to avoid Medicare late enrollment penalties

No. You are not responsible for a late-enrollment penalty (LEP) if you become eligible premium for for the Medicare Part D Extra Help or Low-Income Subsidy (LIS) program. However,

Medicare late enrollment penalty: Amounts and conditions

Learn how to avoid late enrollment penalties for Parts A, B, and D and make the Medicare experience as seamless and pain-free as possible. While a Part D late enrollment penalty may initially appear less significant than Part B penalties, they accumulate over time and remain with you for life. These monthly Part D late enrollment Your Medicare Part D late-enrollment penalty is calculated by multiplying the number of months you were without some form of „creditable“ prescription drug coverage by

Many people aren’t aware that there are deadlines to apply for Medicare and late enrollment penalties if you miss them. Here, we’ll explain which parts of Medicare have late penalties for Parts B After your initial enrollment period, you may have to pay a Medicare Part D late enrollment penalty if you go 63 or more days in a row without a qualifying, or creditable,

When did the penalty for Part D start? The Part D penalty started in 2006, the same year the Part D program began. The Medicare Modernization Act passed in 2003, effective Use our Part D penalty calculator to estimate late enrollment fees for Medicare prescription drug plans. Find out your costs and avoid penalties

KA-02995 What are Medicare late enrollment penalties? October 7, 2022 · En español In most cases, if you don’t sign up for Medicare when you’re first eligible, you may Medicare’s Lifelong Late Enrollment Penalties- How to avoid them and how to appeal them One issue that affects a large amount of Medicare beneficiaries is Late Enrollment Penalties. Learn about how to avoid Late Enrollment Penalty for Medicare Part A, Part B, and Part D. Calculate your estimated Medicare Late Enrollment Penalty using our LEP calculator and find

To avoid Medicare’s Part D late enrollment penalty, you have to have “creditable” drug coverage even if you don’t take many prescriptions

Understanding the Medicare Part D Late Enrollment Penalty

The late enrollment penalty is an amount that’s permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any There are Medicare late enrollment penalties associated with Part A, Part B, and Part D. Find out how to avoid them or get them waived.

Even if you do not take prescriptions currently, enrollment is encouraged when you first qualify for Medicare. If you do not enroll in Part D coverage during your initial enrollment The Medicare Part D late enrollment penalty can sneak up on you if you work past age 65 and have a gap in creditable drug coverage. Medicare Part D Late Enrollment Penalty (LEP) Calculator HOW MUCH IS THE LEP FOR PART D? The Medicare Part D penalty is based on the number of months without PDP coverage. For

Be aware of late enrollment penalties for Medicare Parts A, B, and D. Learn when to sign up for Medicare to avoid costly fees.

The Medicare Part D late enrollment penalty adds 1% of the national base beneficiary premium ($36.78 in 2025) to your Medicare Part D premium for each full month you went without qualifying prescription drug coverage. If available, please attach and submit the plan’s Redetermination decision with your appeal request. For Late Enrollment Penalty Appeal (LEP) requests: Please complete and submit the The late enrollment penalty is an important part of understanding your prescription drug coverage with Medicare. Here’s what you need to know: The late enrollment penalty is applied to members who did not enroll in a

Section 4: How is the Medicare Part D enrollment penalty calculated? The Medicare Part D enrollment penalty is calculated based on the number of months an individual The ever-increasing „cost of waiting“ to enroll in a Medicare Part D plan. The following „maximum penalty“ chart emphasizes the possible costs you may incur if you do not One of the most important things that Medicare beneficiaries need know is that there is a late-enrollment Penalty for Medicare Part A, Part B, and Part D plans. This guide will

A person can enroll in a Medicare Part D drug plan during the 3-month eligibility period with Part for Original Medicare. Missing this deadline results in a late enrollment penalty.

- The Relationship Between Adhd And Social Anxiety Disorder

- The Masters Tournament 2016: Bernhard Langer Beeindruckt Seine Konkurrenten

- The Meaning Of Jesus: Two Visions By Marcus J Borg

- The Mcgee Home Refresh | Everything You Need To Know About Bedroom Styling

- The Npr Classical 50 : Npr _ Beethoven’s Carefully Choreographed Violence

- The Sims 4 Get Famous Bundle Key Im Mai 2024 » 11.71

- The School Of Ballet Arizona: Studio Company Showcase

- The Mayday Foundation Usa , Thank you for visiting to learn more about the Mayday Movement

- The Myth Of Water Rationing While Stranded In The Desert

- The Masks That Created Nba Superheros