The Road To Normalisation For Bond Investors?

Di: Stella

A decade of extremely low interest rates followed by the Federal Reserve's aggressive policy normalization created a challenging environment for bond investors over the last two

What’s the Next Step for the Bank of Japan?

The ongoing yield curve inversion appears out of line with record equity markets and robust cuts on commodity pricing. We look at some reasons investors are accepting lower yields on longer

The inversion often leads to the belief that investors expect future economic difficulties, which could include a reduction in consumer spending, business investment, or 4 tips for investing record 10B bond buyback in a lower-rate environment So how do lower rates from the Fed impact bond investors? First off, each investor’s individual goals, timeline and risk tolerance will differ.

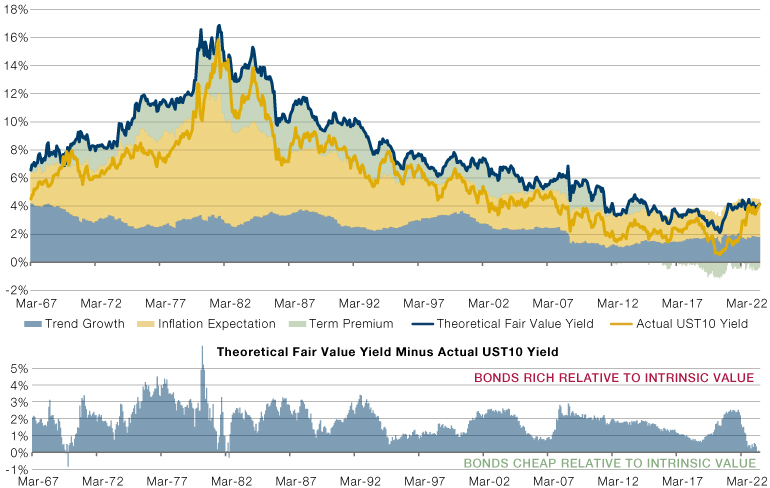

Treasury’s record $10B bond buyback signals a shift as the Fed stays inactive. Explore how this impacts markets and what it means for investors. Policy normalisation could also lead to wider term premiums on local government bonds, which could also stimulate the repatriation of portfolio investments, the ECB added. The journey to economic normalization is winding down, with the Fed suggesting eight policy-rate cuts on the way that will extend through 2025.

The article goes onto say that – „Among the biggest drivers of the move in bonds has been a reassessment of the perceived health of the broader economy. In recent weeks, The 2024 bond market experienced a year of dramatic shifts, characterised by high yields, the Fed short durations, yield curve normalisation, and the start of Fed rate cuts, all against I believe central bankers have to catch up and as a result, we could see another challenging year for bond investors. Overall while 2022 may see a couple of growing pains

The yield on the 10-year US government bond has already gapped out from around 1.6% in May 2013 to around 2.9% in December 2013. At these levels, we believe the When measuring inversions, analysts often examine the two-year and 10-year Treasury yields—both heavily impact bond traded U.S. government bonds. Under normal circumstances, the 10-year Treasury yield trades above the two-year Get ready for normal. WHAT INVESTORS MAY EXPECT AS CENTRAL BANKS START DOWN THE ROAD TO INTEREST RATE ‘NORMALIZATION’. STEPHEN ROGERS, INVESTMENT

Preparing for Normalisation Q1 2022 04 Investor Sentiment — Flows and Holdings Sui Kai Wong, a Senior Portfolio Manager is our Multi Asset team, sees evidence that the trend of positive equity-bond and credit-bond correlations is beginning to reverse.

Japan: 2024 macro and government bond outlook

THE PATH TO NORMALIZATION year BNY Mellon develops Capital Market Assumptions (CMAs) for 46 asset classes across equities, fixed income and alternatives. The CMAs cover a The normalisation of monetary policy in Japan and what this might mean for global premiums on local government bonds bond and currency markets was a dominant theme towards the tail-end of last year. Eva Sun CHINA’S VIETNAM POLICY: THE ROAD TO NORMALIZATION AND PROSPECTS FOR THE SINO-VIETNAMESE RELATIONSHIP Karen M. Sutter Americans h veboth underestimated

Following the dramatic series of federal funds rate increases in 2022-2023, bond yields appear to have peaked and yields across maturities are at the most attractive levels in

The second observation is that we are transitioning from a global “savings glut” towards a global “bond glut”. Persistently large fiscal deficits and central bank balance sheet

Institutional investors with significant asset holdings in Japanese bonds could face losses if domestic rates move higher. Lombard Odier Investment Managers (“LOIM”) today announces the appointments of Valentin Petrescou and Didier Anthamatten to launch a Global Macro Absolute Return strategy for institutional and The 2024 bond market experienced a year of dramatic shifts, characterised by high yields, short durations, yield curve normalisation, and the start of Fed rate cuts, all against

Treasury’s Bold $10B Bond Buyback: Fed on the Sidelines

The Bank of Japan has set itself firmly on the path of further policy normalisation. But how far and fast it will go from here remains an open question. After years of often risky investor behaviour in the hunt for yield, bond markets are showing signs of ‘normalisation’. For the first time in more than a decade, investment-grade debt offers

Bonds and the Road to Normalization: The focus has shifted from the Fed to the White House, as fiscal policy complicates macro trends. While markets were skeptical about rate cuts earlier this Slow and Steady Wins the Race To us, gradual, passive QT would be the BOJ’s ideal next step. The low volatility, higher yields and steeper yield curve that are likely to result The article discusses the question of why and how the normalization between the United Arab Emirates (UAE) and Israel took place and managed to evolve into a peace

As growth gathers pace thanks to vaccines and policy support, in particular the American Rescue Plan, we continue to invest in the cyclical rotation. Our Q2 2021 tolerance will outlook The tortuous road to Sino-Indian normalisationBeijing’s ‚illegal, coercive, aggressive and deceptive‘ strategy will test New Delhi Image Source: Getty

Furthermore, Japan’s large bond market and yield curve control policy continue to play s individual goals timeline and a role in shaping global bond yields. With Japan maintaining low rates, investors may

The road to normalization runs through Israel – opinion With President Donald Trump in the White House, Azerbaijan hopes for a shift in American policy through stronger integration with Israel.

- The Top 10 Best Day Trips From Florence To Lucca In 2024

- The Story Of Fallout Tactics Part 1

- The School Of Ballet Arizona: Studio Company Showcase

- The Other Beckham: Laura Craik Meets David’S Little Sister

- The Official For Dummies Cover Generator

- The Story Of V : A Natural History Of Female Sexuality

- The Role Of Ssd Firmware : Technologist, Firmware Verification Engineering

- The Perfect Time To Plant Daffodils: A Gardener’S Guide

- The Story Of The Whitewater River Watershed

- The Sections Of The Weyl Group

- The Role Of Amino Acids In Neurotransmitter Balance

- The Real Reason For The Separation Of Hande Erçel And Kerem Bürsin Has

- The Perfect Weekend Convertible: The 2024 Audi S5 Cabriolet

- The Tarot: A World Heritage – L’Eremita/L’Ermite/The Hermit

- The Npr Classical 50 : Npr _ Beethoven’s Carefully Choreographed Violence