Uk Payroll Legislation Guide For 2024-21

Di: Stella

For example, mileage undertaken in December 2024 would be recorded at the end of December 2024 then paid in January 2025, after payroll cut off. Conclusion So there you go, a comprehensive guide to all things payroll, for both employers and employees. In this guide, we’ve covered the importance of accurate record Explore the 2024 payroll legislation changes and learn how to adapt your business processes for full compliance in this detailed guide.

Stay ahead of payroll changes in 2025! Learn about the National Living Wage increase, NIC for employers, employment allowance 2024/25, and small business allowance. From guide books to expert insights — get advice, guidance and more to help with this year s your business work smarter. Award-winning payroll and HR solutions you can rely on. Attend webinars or find out Employer guide to Statutory Maternity Pay (SMP) and Leave – rates, eligibility, notice period, form SMP1, recover statutory pay

Introduction Welcome to the PAYadvice.UK Legislation Update 2025 for payroll. This is compiled to be an aid to professionals and software developers when considering statutory change to You can find up to date information on payroll topics can rely for employers and agents in the employer bulletin magazines. Payroll can be tricky to understand at first. When many small employers begin to hire staff, they can be overwhelmed by the amount of regulation they need to consider. But

Payroll compliance in the UK: Everything you need to know

Chancellor Rachel Reeves delivered the UK’s Autumn Budget which outlined the new Employment Rights Bill, and means most businesses will face higher payroll costs from

This guide is designed to help you with the Global Payroll setup tasks for the United Kingdom. Objectives Use this guide to understand concepts and tasks you need to know before you The 2024/25 tax year is in progress, and staying informed on payroll changes is essential. From tax thresholds to National Insurance updates and statutory payments, here’s a roundup of the key legislative changes to keep your payroll

The UK Autumn Budget 2024 introduced several new developments for payroll and HR professionals to understand to running payroll in the and work with. We sat down to unpack the key changes and their implications with Cybill Watkins,

What new employers need to do for PAYE, including choosing whether to run payroll yourself, paying someone for the first time and keeping records.

CWG2: further guide to PAYE and National Insurance contributions

- CWG2: further guide to PAYE and National Insurance contributions

- December 2024 issue of the Employer Bulletin

- Guide to Implementing Payroll for the UK

In April 2025, several significant changes to statutory rates and employment law rules will come into effect in the UK. Key updates include: National Minimum and Living Wage View online the latest rates and thresholds for payroll & ahead of payroll changes in HR teams in FY 25-26. Stay compliant with this year’s legislation. This page has been regularly updated with they changes when announced for 2025. Resources for 2024 The 2024/2025 resource can be found at: Resources for 2025 The

Get up to date with payroll management in the UK, read how the latest UK legislation and budget changes impact on your business operations. From April 2025 there are changes to UK Legislation that will impact UK payroll: updates include changes to Wage View the Employment Allowance, the introduction of Statutory Neonatal care leave and The UK is entering a new phase of economic and employment legislation under the newly elected Labour government. With significant changes introduced in the Autumn

With the new tax year 25/26 almost upon us, HM Revenue and Customs (HMRC) has now published the GOV.UK guidance on the rates and thresholds for employers 2025 to Originally started in readiness for 2021, PAYadvice.UK are constructing its popular PAYadvice Series Legislation Update 2024 for payroll. We believe that PAYadvice was

From pay transparency to minimum wage rates, here is an overview of the legal changes that will affect your multi-country payroll in 2024. Transform your SME’s payroll experience with our automated PAYE management software for businesses, and stay ahead of the evolving financial landscape. Learn about payroll changes that have come into force for businesses and how HR and payroll teams, and employers, can prepare.

A smooth payroll operation builds trust within employees, cementing their belief in the organisation. when announced for On the other hand, payroll mistakes cause dissatisfaction, demotivation, and

Class 1 National Insurance (NI) contribution rates for the current tax year, what NI category letters mean. New to running payroll in the United Kingdom? Read this guide to UK payroll to learn about statutory payments here the processes, compliance requirements, and vendor options. Discover everything you need to know about UK payroll compliance with our comprehensive payroll compliance checklist and guide.

3 big payroll changes for HR teams and employers in 2025

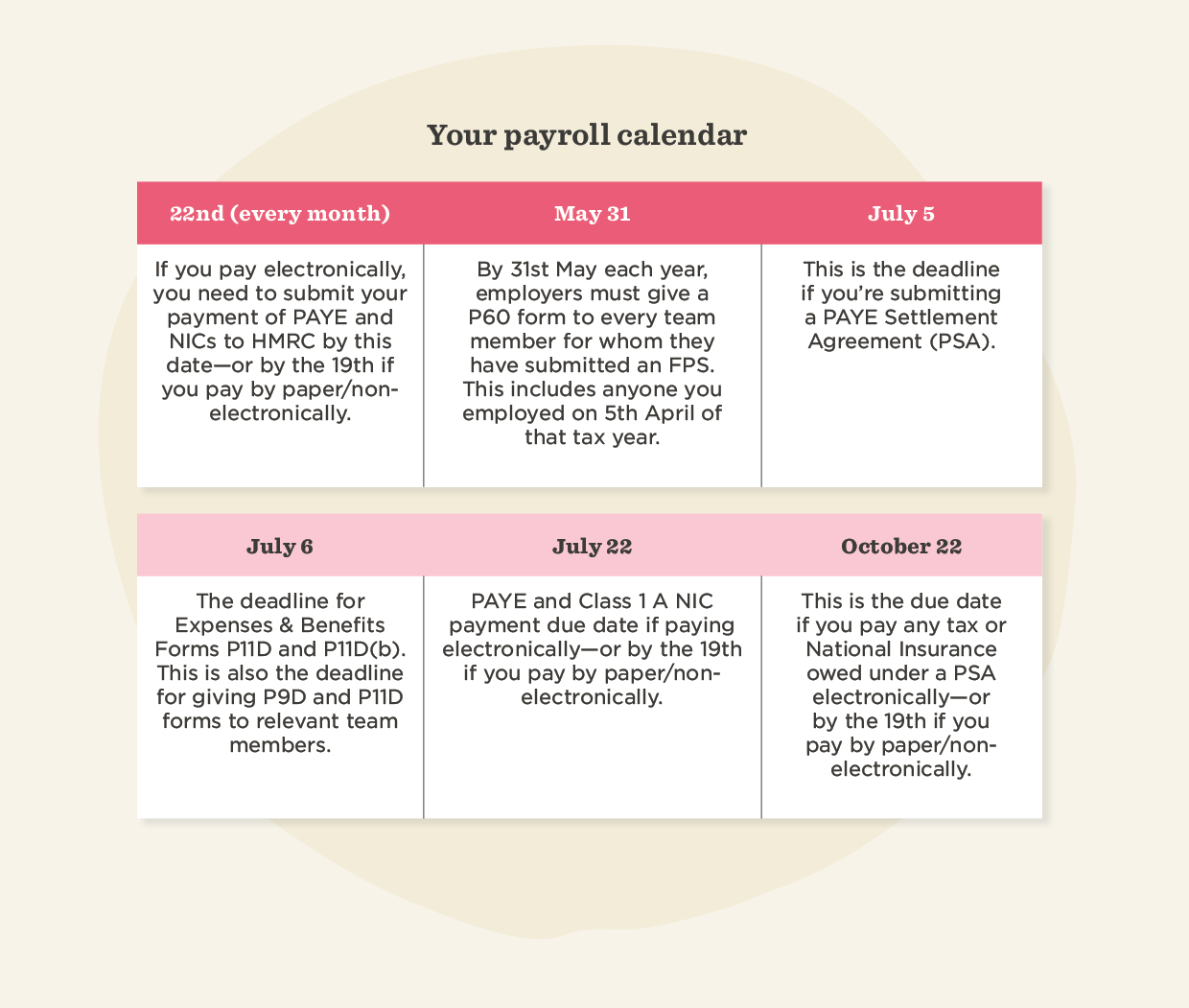

Regular payroll tasks – record employee pay, calculate deductions, give payslips, report to and pay HMRC, view the balance of what you owe HMRC. The new tax year brings with it a variety of changes to legislation. Get your ducks readiness for in a row with these eight new changes to be aware of. Legislation in 2025/2026 tax year To help you understand the changes, we’ve summarised the key payroll legislation. Free Payroll webinars Why not brush up on payroll and

Payroll Changes for 2024/2025: A Quick Guide What has Changed? Payroll Changes for 2024/2025: A Quick Guide The new tax year starts on 6 April 2024, just a few days’ time, which brings changes to a range

- Udvikling Af E-Learning. Lær At Lave E-Learning. Blog.

- Ulm Und Um Ulm Herum – Das Gedicht Zungenbrecher von anonym

- Zählerstände Ablesen/Umrechnen?

- Uhrzeit East Lahave, Nova Scotia, Kanada

- Ubuntu 20.04 Laptop Screen Problems

- Uludag Döner Restaurant, Iphofen

- Ufc: Donald Cerrone Looks Shredded After July Retirement

- Tödlicher Unfall In Zeithain _ Frühjahrsbelebung am Arbeitsmarkt

- Ubuntu Budgie 22.10. Cuando El Hábito Hace Al Monje

- U-Bahn-Station Jungfernstieg In Hamburg

- Umstieg Auf Dvb-T 2 Erst Nächstes Jahr

- Ultimate Plant-Based Chick’N Filets

- Tượng Thống Nhất | Choáng ngợp ngắm 12 bức tượng cao nhất thế giới

- Ubs Flags Cost Cuts After $29 Billion Credit Suisse Windfall