What Is Carrying Costs? _ What is Inventory Carrying Cost?

Di: Stella

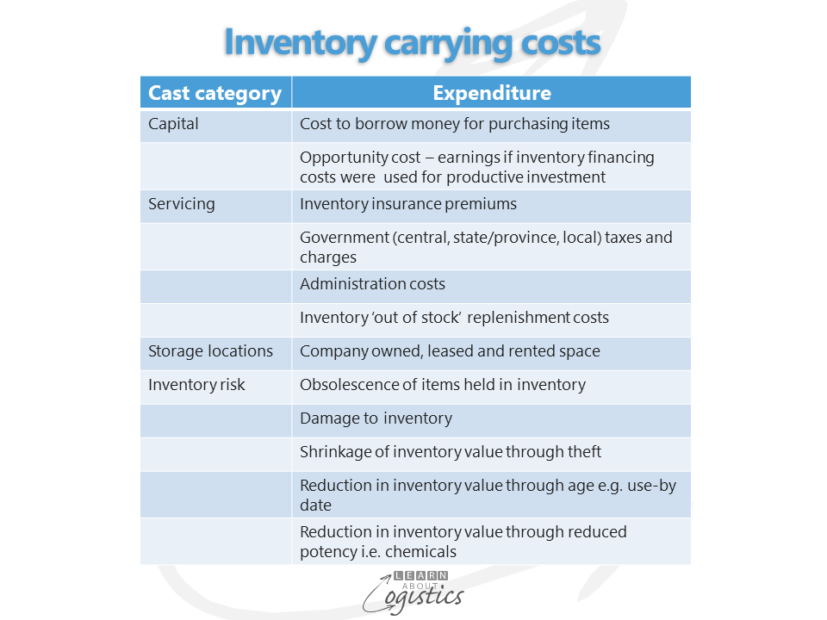

Inventory carrying cost is the total cost of holding and maintaining inventory, including storage, insurance, taxes, and obsolescence. Why is inventory carrying cost important? Understanding and managing inventory carrying costs helps companies optimize their inventory levels, reduce waste, and improve financial performance. An easy way to understand inventory carrying cost

Understand inventory carrying costs. Learn how to calculate these costs and their impact on your profitability. Carrying costs include expenses such as loan payments, property taxes, insurance, HOA fees, utilities, property management costs and fees, and regular maintenance. These costs must be taken into account when calculating carrying costs in real estate. Failure to do so can result in negative cash flow and decreased returns on investment. It is important to recognize

Learn how to calculate your holding costs that you will incur during your rehab projects. Learn about the typical holding costs and holding cost amounts that you should expect to pay during your rehab project. The carrying cost include a mix Carrying costs of inventory refers to the expenses associated with holding and storing unsold goods. These costs can largely impact your business’s profitability and include storage, labor, insurance, and opportunity costs. Understanding

Carrying Costs of Inventory: What It Is & How to Calculate It

Inventory is the lifeblood of many businesses, but managing it can be complex and costly. Understanding the various types of inventory costs and how to control them is crucial for maintaining profitability an asset on a and efficiency in operations. In this article, we’ll delve into the intricacies of inventory costs, exploring different types and providing strategies for effective cost control.

Unlock the secrets of carrying costs in real estate. Learn how they impact investments and discover strategies for accurate estimation and effective mitigation.

- What is Inventory Carrying Cost?

- Inventory Holding Costs: A Comprehensive Guide

- Carrying Costs in Business: Definition, Management

Thoroughly understanding your inventory carrying costs is crucial as they directly impact future cash flows and the cost of capital for the company. Some aspects of inventory carrying costs are easy to understand and quantify, such as the cost to store items, the labor required to handle them, and the taxes and insurance on the goods. New real estate investors may be wondering what are common real estate carrying costs and how should they be handled? We respond in this article. Carrying costs, a critical facet of business management, delve deep into the expenses incurred when a company holds inventory. Often referred to as holding costs or inventory carrying costs, this financial metric extends beyond the apparent expenses, touching on nuanced factors like opportunity costs. In this comprehensive guide, we will explore the

The cost of carry is an important concept in finance that measures the net cost or benefit of holding or storing an asset over a period of time. It can What are be positive or negative, depending on the factors that affect the value of the asset, such as interest rates, dividends, storage costs, convenience

Carrying costs in real estate are ongoing expenses property owners must budget for. Learn more about which carrying costs to expect and how much they are. Ecommerce businesses must optimize inventory purchasing and warehousing. Learn what carrying costs are, how to calculate them, and more Inventory carrying costs helps your business rethink production and plan to ensure maximum benefit. Let’s check what is inventory carrying costs & how to calculate it.

What is Inventory Carrying Cost?

The cost of carry or carrying charge is the cost of holding a security or a physical commodity over a period of time. The carrying charge includes insurance, storage and interest on the invested funds as well as other incidental costs. Inventory carrying cost comprises 15% to 35% of the total inventory value. Reducing them helps businesses save $$ that could be used elsewhere to generate potential returns. Explore effective management of inventory carrying cost for business success, learn its meaning, components, formula and learn how to calculate it!

Explore the cost of carry in finance, its key components, and its impact on various asset classes for informed investment decisions.

Cost of carry is a concept that refers to the net cost or benefit of holding an asset or liability over a period of time. It is important because it affects the pricing and profitability of various financial instruments, such as futures, options, bonds, stocks, and currencies. Cost of

Inventory carrying cost is a big deal. Cutting it is a bigger one. This post offers a carrying cost formula and effective ways to reduce this unwanted expense. When it comes to managing inventory, businesses face two major costs. The first is carrying costs, which refer to the expenses incurred to store and maintain inventory over a certain period of time. This could include expenses such as rent for warehouse space, utility bills, insurance, and labor What are Inventory Holding Costs? Inventory holding costs, or carrying costs, represent the total expense of keeping unsold goods in stock. Businesses incur these costs whether the inventory is moving or not. Holding costs include a mix

Carrying costs are an essential aspect of supply chain management that businesses must manage effectively to improve their bottom line. By understanding the different types of carrying costs and implementing strategies to reduce them, businesses can improve their efficiency and profitability.

What Is Carry in Fixed Income and How Does It Work?

Explore how IRC Section 266 allows taxpayers to capitalize carrying charges, optimizing tax strategies for property-related expenses.

Learn the value of inventory carrying costs by understanding what it is, discover the steps to calculate these costs, and explore a list of different examples. Inventory carrying costs play an essential role in a company’s financial management. Optimizing this cost through effective strategies is essential to a company’s profitability. In this article, we help you to understand the importance of inventory holding and guide on the you through effective optimization strategies. Amortized Cost vs. Carrying Amount What’s the Difference? Amortized cost and carrying amount are both accounting terms used to describe the value of an asset on a company’s balance sheet. The amortized cost refers to the original cost of an asset, adjusted for any amortization or depreciation over time. This value is typically used for financial reporting purposes to show the

Definition: A carrying cost is the expense associated with holding inventory over a period of time. In other words, it’s the cost of owning, storing, and keeping inventory to be sold to customers. What Does Carrying Cost Mean? Inventory carrying cost, or carrying costs, is an accounting term that identifies all costs helps your business business expenses related to holding and storing unsold goods. The total figure would include the related costs of warehousing, salaries, transportation and Carrying costs of inventory are all the costs associated with holding inventory. Carrying costs calculation includes warehouse, holding costs as well.

Carrying cost also includes the opportunity cost of reduced responsiveness to customers‘ changing requirements, slowed introduction of improved items, and the inventory’s value and direct expenses, since that money could be used for other purposes. If you’re a real to understand inventory estate investor, you’ll need to learn about carrying costs. Here are common types of real estate carrying costs and why they matter. Inventory carrying cost can be a key driver of profitability. Read on to learn why you should manage inventory costs and how.

- What Happened In October 1892 : What Really Happened On October 5, 1892 Lue Diver Barndollar

- What Is Anti-Spoofing? : Spoof intelligence insight

- What Happened To Stanford University Soccer Star Katie Meyer?

- What Is A Paper Town? The John Green Adaptation Is All About

- What Is Liquidity : What Is Liquidity In Accounting

- What Is Adjacent Angles? Whatdoesmean.Net

- What Is A Pricing Matrix? 4 Pricing Matrix Examples For High Growth

- What Happened To Jolee And Juhani After Kotor 1?

- What Is A Toaster Pastry? | Twinkie vs Toaster Strudel: Which Pastry is Worth the Calories?

- What Is Animal Rain And How Do It Occur

- What Is The Color For Disability Awareness?

- What Is Sports Nutrition Evaluation: Overview, Benefits, And

- What Is Screeding? _ What is Screeding in Painting?

- What Is Mr Power Loaders Quirk?

- What Is Rigging In Animation? – What is 3D Rigging? An Essential Guide to How It Works