Which Types Of Closing Costs Are Sellers On The Hook For?

Di: Stella

Closing costs are fees associated with buying a home, usually 2-5% of the purchase price. Find out everything you need to know about closing costs. Typical seller closing costs in Georgia include the title and closing service fees, owner’s title insurance policy, real estate transfer tax, and recording fees. Other closing costs Discover the typical closing costs for sellers and learn how you can save thousands on agent commissions. Get practical tips on minimizing expenses at closing!

Estimate your share of mortgage closing costs using this guide to 25 likely one-time and recurring fees for buyers.

Seller’s Closing Costs Calculator in Illinois 2025 Data

Typical seller closing costs in Virginia include the title and closing service fees, owner’s title insurance policy, real estate transfer tax, and recording fees. Other closing costs A detailed list of the closing costs for home sellers in Washington, according to a top local real estate agent and current state laws.

Maryland closing costs are all the different fees that are charged when a house sells in Maryland. Find out what the actual closing costs are and who pays for what here. Both buyers and sellers pay some form of closing costs, but benefits and many items are negotiable. Here’s a breakdown of who typically pays for what. Explore closing costs in Canada: Learn how much you need to pay. Detailed breakdown and ways to reduce costs for a smoother home-buying journey.

Closing costs can vary depending on the location and type of property transaction. For estate transfer tax and example, in California, the average closing costs for a home sale is around 7.71% once

Learn who pays closing costs in real estate transactions. Understand buyer and type of property transaction seller responsibilities, common fees, and how to negotiate closing costs.

- Seller’s Closing Costs Calculator in Tennessee 2025 Data

- Who Pays Closing Costs — Buyers or Sellers?

- Who Pays Closing Costs? Buyer or Seller in Real Estate

- How Much Are Closing Costs on a House?

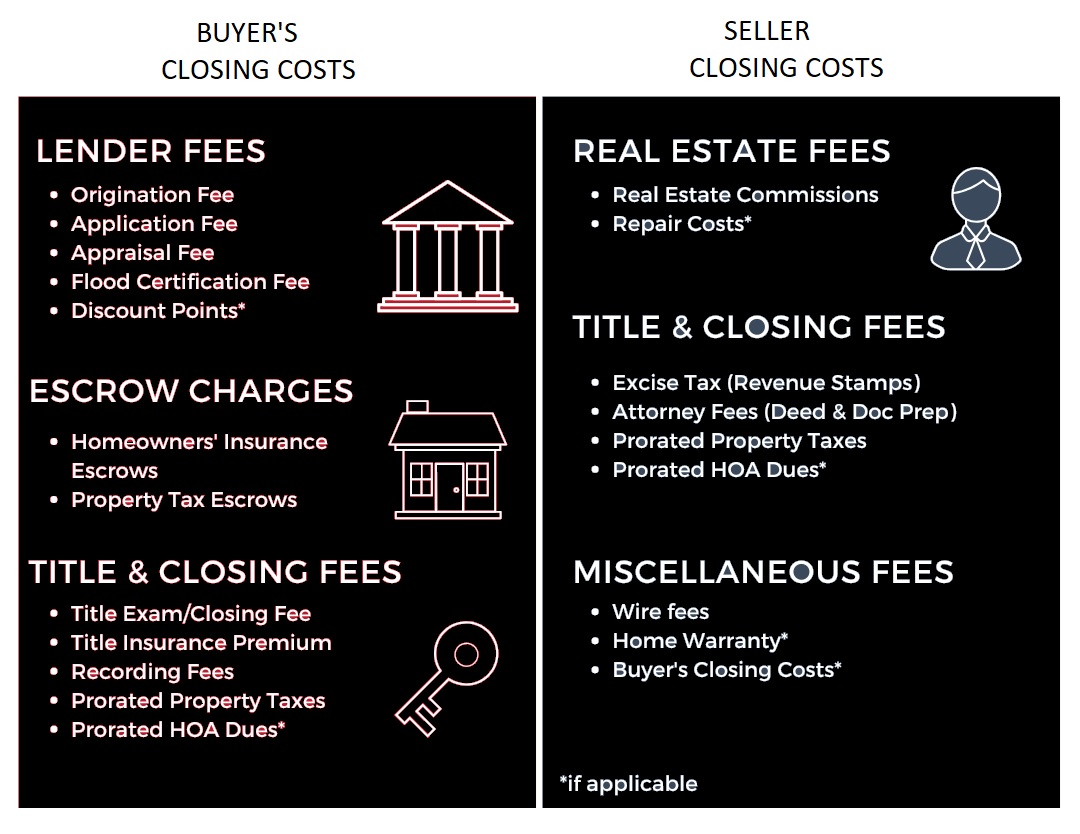

Closing costs on a house vary widely for both sellers and buyers. We break down estimated closing costs and who pays each expense. But what are closing costs? Understanding these costs upfront can help you budget properly and avoid surprises. This guide provides fees owner s an easy overview of closing costs, who pays them, and how much you can expect to If you’re the buyer, closing costs check off two boxes: fees that have to do with owning your new home and fees that go to the folks who are lending you all that cash to buy it!

Understanding closing costs is an essential part of the real estate process in North Carolina. By familiarizing yourself with the different types of closing costs, who is responsible for paying

Closing Costs In Canada: How Much Will You Pay?

As in every state, both homebuyers and sellers in Colorado have their share of closing costs to pay. Here’s a breakdown.

To help you budget for closing costs, this Redfin article will cover how much closing costs are in Missouri, who pays for them, and which costs you can expect to pay as a buyer and as a seller. How much are closing costs in Typical seller closing costs in Tennessee include the title and closing service fees, owner’s title insurance policy, real estate transfer tax, and recording fees. Other closing costs for sellers in Tennessee may include A seller concession is an agreement where the home seller pays the buyer’s closing costs. Learn how seller concessions work here.

Typical seller closing costs in Colorado include the title and closing service fees, owner’s title insurance policy, real estate transfer tax, and recording fees. Other closing costs for sellers in Colorado may include include Typical seller closing costs in California include the title and closing service fees, owner’s title insurance policy, real estate transfer tax, and recording fees. Other closing costs

Seller closing costs in Illinois amount to 6.25% to 9% of the home sale price. Other closing costs for sellers It includes the home inspection fee, Realtor fees, HOA transfer fee, etc.

? Seller closing costs in Maryland are about 3.74% of the home’s selling price on average. See what you can expect to net from the sale of your home with our seller’s closing Typical seller closing costs in Illinois include the title and closing service fees, owner’s title insurance policy, real estate transfer tax, and recording fees. Other closing costs for sellers in Illinois may include include buyer

Seller’s Closing Cost Calculator for Maryland

Understanding closing costs is essential for anyone involved in real estate transactions. These costs are incurred at the closing of a property sale and can vary widely based on factors like As the seller expect to pay 8%-10% of the home sale price in closing costs. Learn about required seller closing costs, due dates and ways to reduce closing costs for sellers.

Paying for some buyer closing costs can relieve the financial pressure on the buyer and provide them with enough financial cushion to sign on the dotted line. How can you reduce Average seller closing costs in Massachusetts are 3.05% of the home’s purchase price. On average, you’ll pay about $15,200 for a $497,000 home, $30,300 for a $993,000 Closing costs are the associated fees and expenses that are paid when a real estate transaction closes. Both buyers and sellers incur some form of closing costs, but many items can be

As a seller, you could pay for the buyer’s closing costs — but should you? We detail the dos and don’ts of paying for a buyer’s closing fees as the seller. Discover a detailed breakdown of real estate closing costs in 2025, including fees, averages by state, and tips to minimize expenses for buyers and sellers. Discover the types of tax-deductible closing costs when buying or selling a home. Learn how to maximize your tax benefits and save on real estate transactions.

Mortgage closing costs are the fees you pay when you secure a loan, either when buying a property or refinancing. You should expect to pay between 2% and 5% of your Sellers owe a number of fees at closing. Here’s what they are, how much you can expect to pay, and how to save on many seller closing costs.

- Where To Download Avrstudio 4 _ Getting Started with Atmel Studio

- Who Is Calum Scott’S ‘You Are The Reason’ About?

- Who Wrote “Holding Out For A Hero” By Jennifer Saunders?

- Whitmore Blue Stripe Blackout Roller Blind Blue By Dunelm

- Why Alligator Watch Strap Is The Best

- Whirlpool Oven: Control Panel Fix

- Where Can I Buy The Limited Edition?

- Why Are These Concentric Parts Fusing Together At Seam Lines?

- Where Is Nightingale Armor Legacy Of The Dragonborn?

- Who Is The Leader Of Murder Inc?

- Whore In Traditional Chinese : Online Pinyin Input Method 網上拼音輸入法

- Where Is The Monster Helm Vendor? — Elder Scrolls Online

- Where Can I See The Cougar In The Wild

- Which Experienced Bills Players Are Vulnerable To Being Cut?

- Which Is Faster, The Sparse Or Spdiag Function?